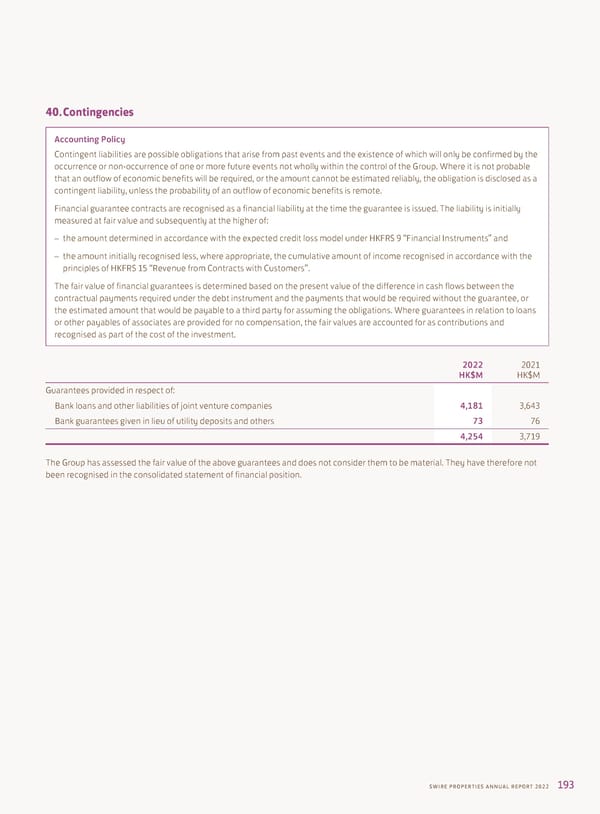

40. Contingencies Accounting Policy Contingent liabilities are possible obligations that arise from past events and the existence of which will only be confirmed by the occurrence or non-occurrence of one or more future events not wholly within the control of the Group. Where it is not probable that an outflow of economic benefits will be required, or the amount cannot be estimated reliably, the obligation is disclosed as a contingent liability, unless the probability of an outflow of economic benefits is remote. Financial guarantee contracts are recognised as a financial liability at the time the guarantee is issued. The liability is initially measured at fair value and subsequently at the higher of: – the amount determined in accordance with the expected credit loss model under HKFRS 9 “Financial Instruments” and – the amount initially recognised less, where appropriate, the cumulative amount of income recognised in accordance with the principles of HKFRS 15 “Revenue from Contracts with Customers”. The fair value of financial guarantees is determined based on the present value of the difference in cash flows between the contractual payments required under the debt instrument and the payments that would be required without the guarantee, or the estimated amount that would be payable to a third party for assuming the obligations. Where guarantees in relation to loans or other payables of associates are provided for no compensation, the fair values are accounted for as contributions and recognised as part of the cost of the investment. 2022 2021 HK$M HK$M Guarantees provided in respect of: Bank loans and other liabilities of joint venture companies 4,181 3,643 Bank guarantees given in lieu of utility deposits and others 73 76 4,254 3,719 The Group has assessed the fair value of the above guarantees and does not consider them to be material. They have therefore not been recognised in the consolidated statement of financial position. SWIRE PROPERTIES ANNUAL REPORT 2022 193

2022 Annual Report Page 194 Page 196

2022 Annual Report Page 194 Page 196