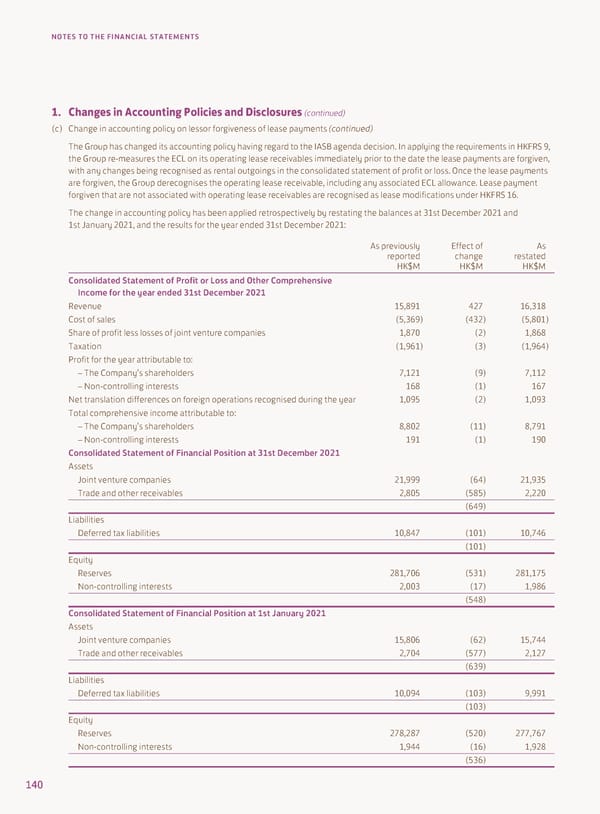

NOTES TO THE FINANCIAL STATEMENTS 1. Changes in Accounting Policies and Disclosures (continued) (c) Change in accounting policy on lessor forgiveness of lease payments (continued) The Group has changed its accounting policy having regard to the IASB agenda decision. In applying the requirements in HKFRS 9, the Group re-measures the ECL on its operating lease receivables immediately prior to the date the lease payments are forgiven, with any changes being recognised as rental outgoings in the consolidated statement of profit or loss. Once the lease payments are forgiven, the Group derecognises the operating lease receivable, including any associated ECL allowance. Lease payment forgiven that are not associated with operating lease receivables are recognised as lease modifications under HKFRS 16. The change in accounting policy has been applied retrospectively by restating the balances at 31st December 2021 and 1st January 2021, and the results for the year ended 31st December 2021: As previously Effect of As reported change restated HK$M HK$M HK$M Consolidated Statement of Profit or Loss and Other Comprehensive Income for the year ended 31st December 2021 Revenue 15,891 427 16,318 Cost of sales (5,369) (432) (5,801) Share of profit less losses of joint venture companies 1,870 (2) 1,868 Taxation (1,961) (3) (1,964) Profit for the year attributable to: – The Company’s shareholders 7,121 (9) 7,112 – Non-controlling interests 168 (1) 167 Net translation differences on foreign operations recognised during the year 1,095 (2) 1,093 Total comprehensive income attributable to: – The Company’s shareholders 8,802 (11) 8,791 – Non-controlling interests 191 (1) 190 Consolidated Statement of Financial Position at 31st December 2021 Assets Joint venture companies 21,999 (64) 21,935 Trade and other receivables 2,805 (585) 2,220 (649) Liabilities Deferred tax liabilities 10,847 (101) 10,746 (101) Equity Reserves 281,706 (531) 281,175 Non-controlling interests 2,003 (17) 1,986 (548) Consolidated Statement of Financial Position at 1st January 2021 Assets Joint venture companies 15,806 (62) 15,744 Trade and other receivables 2,704 (577) 2,127 (639) Liabilities Deferred tax liabilities 10,094 (103) 9,991 (103) Equity Reserves 278,287 (520) 277,767 Non-controlling interests 1,944 (16) 1,928 (536) 140

2022 Annual Report Page 141 Page 143

2022 Annual Report Page 141 Page 143