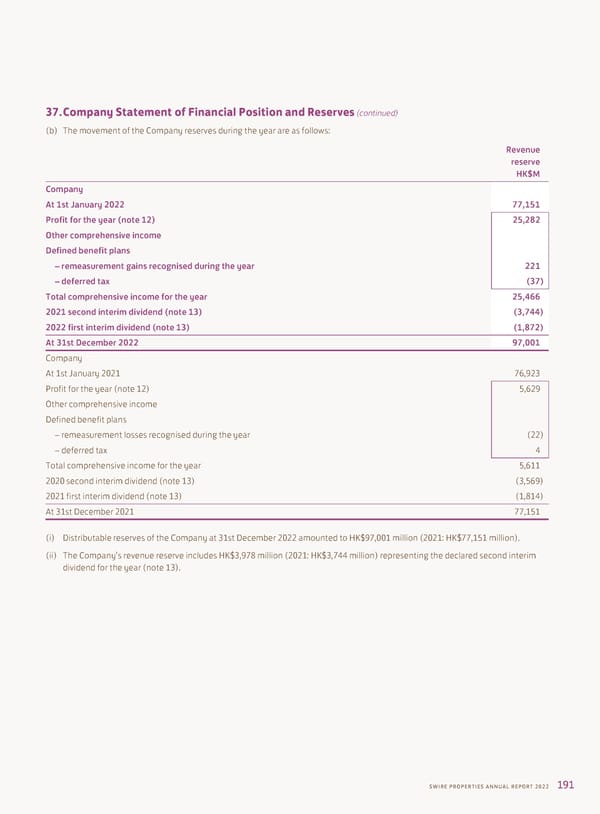

37. Company Statement of Financial Position and Reserves (continued) (b) The movement of the Company reserves during the year are as follows: Revenue reserve HK$M Company At 1st January 2022 77,151 Profit for the year (note 12) 25,282 Other comprehensive income Defined benefit plans – remeasurement gains recognised during the year 221 – deferred tax (37) Total comprehensive income for the year 25,466 2021 second interim dividend (note 13) (3,744) 2022 first interim dividend (note 13) (1,872) At 31st December 2022 97,001 Company At 1st January 2021 76,923 Profit for the year (note 12) 5,629 Other comprehensive income Defined benefit plans – remeasurement losses recognised during the year (22) – deferred tax 4 Total comprehensive income for the year 5,611 2020 second interim dividend (note 13) (3,569) 2021 first interim dividend (note 13) (1,814) At 31st December 2021 77,151 (i) Distributable reserves of the Company at 31st December 2022 amounted to HK$97,001 million (2021: HK$77,151 million). (ii) The Company’s revenue reserve includes HK$3,978 million (2021: HK$3,744 million) representing the declared second interim dividend for the year (note 13). SWIRE PROPERTIES ANNUAL REPORT 2022 191

2022 Annual Report Page 192 Page 194

2022 Annual Report Page 192 Page 194