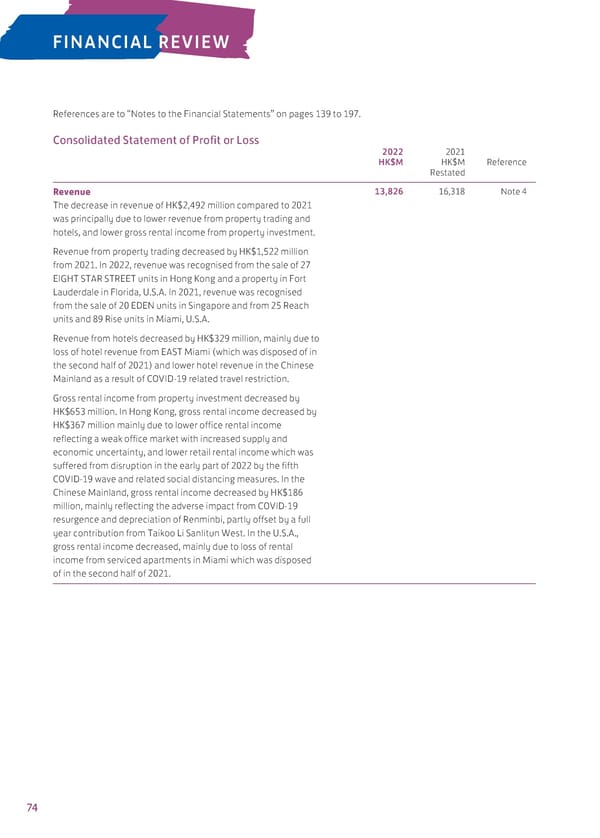

FINANCIAL REVIEW References are to “Notes to the Financial Statements” on pages 139 to 197. Consolidated Statement of Profit or Loss 2022 2021 HK$M HK$M Reference Restated Revenue 13,826 16,318 Note 4 The decrease in revenue of HK$2,492 million compared to 2021 was principally due to lower revenue from property trading and hotels, and lower gross rental income from property investment. Revenue from property trading decreased by HK$1,522 million from 2021. In 2022, revenue was recognised from the sale of 27 EIGHT STAR STREET units in Hong Kong and a property in Fort Lauderdale in Florida, U.S.A. In 2021, revenue was recognised from the sale of 20 EDEN units in Singapore and from 25 Reach units and 89 Rise units in Miami, U.S.A. Revenue from hotels decreased by HK$329 million, mainly due to loss of hotel revenue from EAST Miami (which was disposed of in the second half of 2021) and lower hotel revenue in the Chinese Mainland as a result of COVID-19 related travel restriction. Gross rental income from property investment decreased by HK$653 million. In Hong Kong, gross rental income decreased by HK$367 million mainly due to lower office rental income reflecting a weak office market with increased supply and economic uncertainty, and lower retail rental income which was suffered from disruption in the early part of 2022 by the fifth COVID-19 wave and related social distancing measures. In the Chinese Mainland, gross rental income decreased by HK$186 million, mainly reflecting the adverse impact from COVID-19 resurgence and depreciation of Renminbi, partly offset by a full year contribution from Taikoo Li Sanlitun West. In the U.S.A., gross rental income decreased, mainly due to loss of rental income from serviced apartments in Miami which was disposed of in the second half of 2021. 74

2022 Annual Report Page 75 Page 77

2022 Annual Report Page 75 Page 77