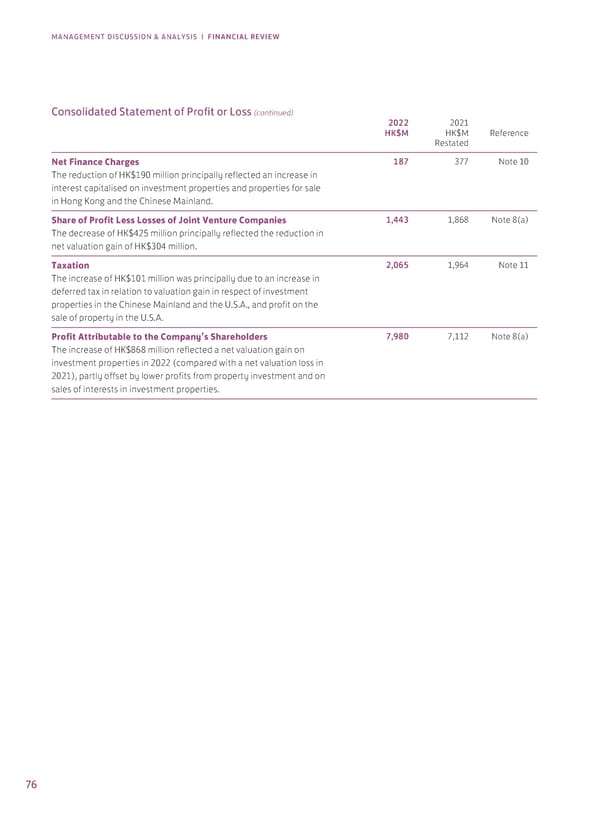

MANAGEMENT DISCUSSION & ANALYSIS | FINANCIAL REVIEW Consolidated Statement of Profit or Loss (continued) 2022 2021 HK$M HK$M Reference Restated Net Finance Charges 187 377 Note 10 The reduction of HK$190 million principally reflected an increase in interest capitalised on investment properties and properties for sale in Hong Kong and the Chinese Mainland. Share of Profit Less Losses of Joint Venture Companies 1,443 1,868 Note 8(a) The decrease of HK$425 million principally reflected the reduction in net valuation gain of HK$304 million. Taxation 2,065 1,964 Note 11 The increase of HK$101 million was principally due to an increase in deferred tax in relation to valuation gain in respect of investment properties in the Chinese Mainland and the U.S.A., and profit on the sale of property in the U.S.A. Profit Attributable to the Company’s Shareholders 7,980 7,112 Note 8(a) The increase of HK$868 million reflected a net valuation gain on investment properties in 2022 (compared with a net valuation loss in 2021), partly offset by lower profits from property investment and on sales of interests in investment properties. 76

2022 Annual Report Page 77 Page 79

2022 Annual Report Page 77 Page 79