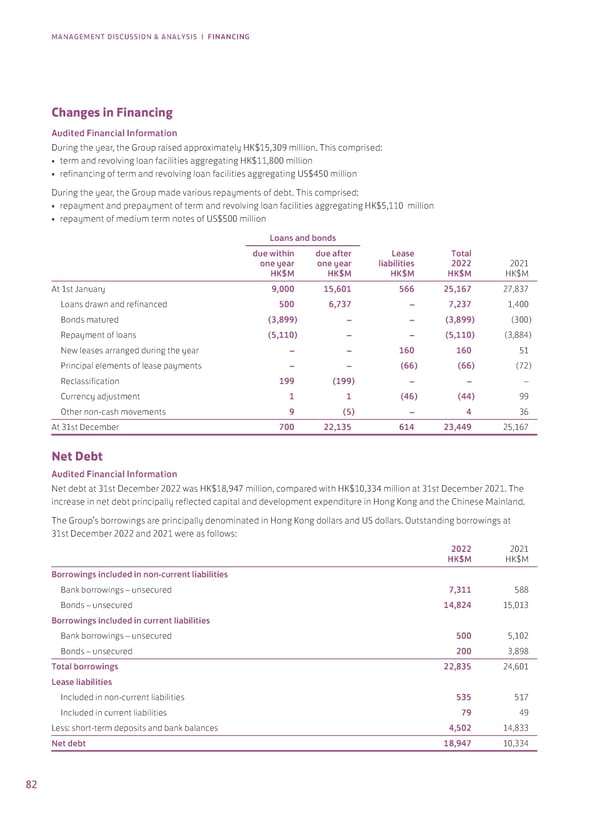

MANAGEMENT DISCUSSION & ANALYSIS | FINANCING Changes in Financing Audited Financial Information During the year, the Group raised approximately HK$15,309 million. This comprised: • term and revolving loan facilities aggregating HK$11,800 million • refinancing of term and revolving loan facilities aggregating US$450 million During the year, the Group made various repayments of debt. This comprised: • repayment and prepayment of term and revolving loan facilities aggregating HK$5,110 million • repayment of medium term notes of US$500 million Loans and bonds due within due after Lease Total one year one year liabilities 2022 2021 HK$M HK$M HK$M HK$M HK$M At 1st January 9,000 15,601 566 25,167 27,837 Loans drawn and refinanced 500 6,737 – 7,237 1,400 Bonds matured (3,899) – – (3,899) (300) Repayment of loans (5,110) – – (5,110) (3,884) New leases arranged during the year – – 160 160 51 Principal elements of lease payments – – (66) (66) (72) Reclassification 199 (199) – – – Currency adjustment 1 1 (46) (44) 99 Other non-cash movements 9 (5) – 4 36 At 31st December 700 22,135 614 23,449 25,167 Net Debt Audited Financial Information Net debt at 31st December 2022 was HK$18,947 million, compared with HK$10,334 million at 31st December 2021. The increase in net debt principally reflected capital and development expenditure in Hong Kong and the Chinese Mainland. The Group’s borrowings are principally denominated in Hong Kong dollars and US dollars. Outstanding borrowings at 31st December 2022 and 2021 were as follows: 2022 2021 HK$M HK$M Borrowings included in non-current liabilities Bank borrowings – unsecured 7,311 588 Bonds – unsecured 14,824 15,013 Borrowings included in current liabilities Bank borrowings – unsecured 500 5,102 Bonds – unsecured 200 3,898 Total borrowings 22,835 24,601 Lease liabilities Included in non-current liabilities 535 517 Included in current liabilities 79 49 Less: short-term deposits and bank balances 4,502 14,833 Net debt 18,947 10,334 82

2022 Annual Report Page 83 Page 85

2022 Annual Report Page 83 Page 85