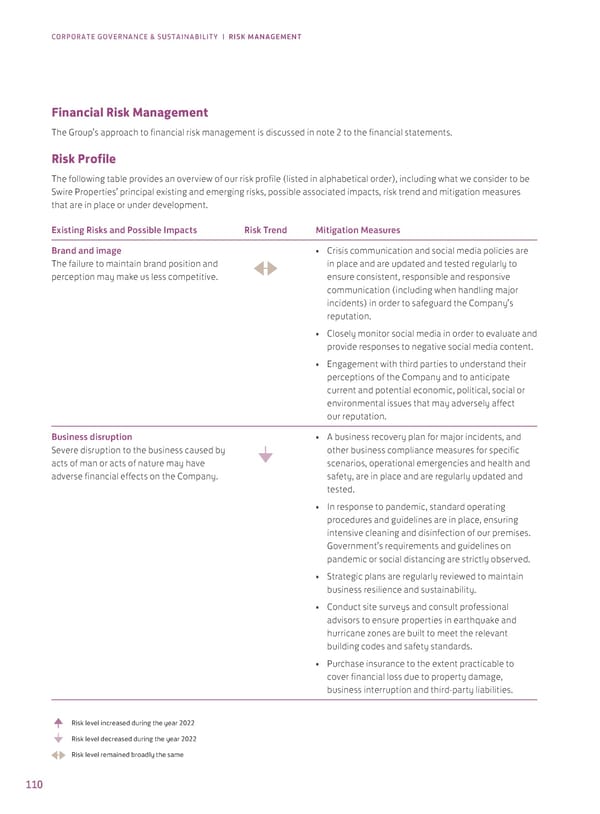

CORPORATE GOVERNANCE & SUSTAINABILITY | RISK MANAGEMENT Financial Risk Management The Group’s approach to financial risk management is discussed in note 2 to the financial statements. Risk Profile The following table provides an overview of our risk profile (listed in alphabetical order), including what we consider to be Swire Properties’ principal existing and emerging risks, possible associated impacts, risk trend and mitigation measures that are in place or under development. Existing Risks and Possible Impacts Risk Trend Mitigation Measures Brand and image • Crisis communication and social media policies are The failure to maintain brand position and in place and are updated and tested regularly to perception may make us less competitive. ensure consistent, responsible and responsive communication (including when handling major incidents) in order to safeguard the Company’s reputation. • Closely monitor social media in order to evaluate and provide responses to negative social media content. • Engagement with third parties to understand their perceptions of the Company and to anticipate current and potential economic, political, social or environmental issues that may adversely affect our reputation. Business disruption • A business recovery plan for major incidents, and Severe disruption to the business caused by other business compliance measures for specific acts of man or acts of nature may have scenarios, operational emergencies and health and adverse financial effects on the Company. safety, are in place and are regularly updated and tested. • In response to pandemic, standard operating procedures and guidelines are in place, ensuring intensive cleaning and disinfection of our premises. Government’s requirements and guidelines on pandemic or social distancing are strictly observed. • Strategic plans are regularly reviewed to maintain business resilience and sustainability. • Conduct site surveys and consult professional advisors to ensure properties in earthquake and hurricane zones are built to meet the relevant building codes and safety standards. • Purchase insurance to the extent practicable to cover financial loss due to property damage, business interruption and third-party liabilities. Risk level increased during the year 2022 Risk level decreased during the year 2022 Risk level remained broadly the same 110

2022 Annual Report Page 111 Page 113

2022 Annual Report Page 111 Page 113