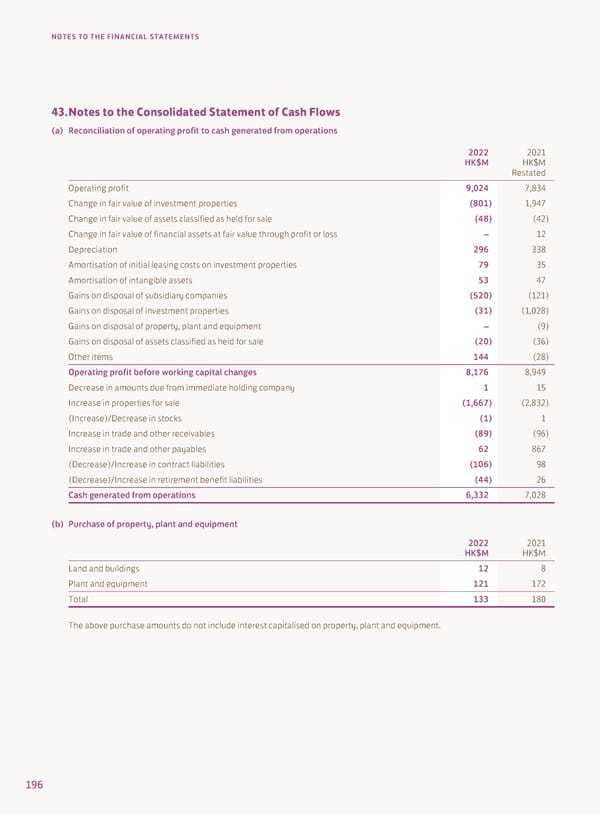

NOTES TO THE FINANCIAL STATEMENTS 43. Notes to the Consolidated Statement of Cash Flows (a) Reconciliation of operating profit to cash generated from operations 2022 2021 HK$M HK$M Restated Operating profit 9,024 7,834 Change in fair value of investment properties (801) 1,947 Change in fair value of assets classified as held for sale (48) (42) Change in fair value of financial assets at fair value through profit or loss – 12 Depreciation 296 338 Amortisation of initial leasing costs on investment properties 79 35 Amortisation of intangible assets 53 47 Gains on disposal of subsidiary companies (520) (121) Gains on disposal of investment properties (31) (1,028) Gains on disposal of property, plant and equipment – (9) Gains on disposal of assets classified as held for sale (20) (36) Other items 144 (28) Operating profit before working capital changes 8,176 8,949 Decrease in amounts due from immediate holding company 1 15 Increase in properties for sale (1,667) (2,832) (Increase)/Decrease in stocks (1) 1 Increase in trade and other receivables (89) (96) Increase in trade and other payables 62 867 (Decrease)/Increase in contract liabilities (106) 98 (Decrease)/Increase in retirement benefit liabilities (44) 26 Cash generated from operations 6,332 7,028 (b) Purchase of property, plant and equipment 2022 2021 HK$M HK$M Land and buildings 12 8 Plant and equipment 121 172 Total 133 180 The above purchase amounts do not include interest capitalised on property, plant and equipment. 196

2022 Annual Report Page 197 Page 199

2022 Annual Report Page 197 Page 199