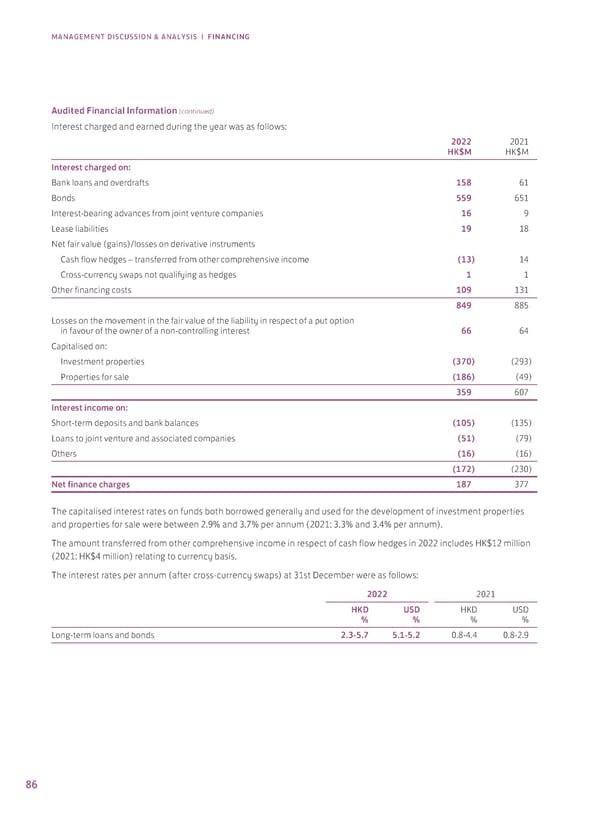

MANAGEMENT DISCUSSION & ANALYSIS | FINANCING Audited Financial Information (continued) Interest charged and earned during the year was as follows: 2022 2021 HK$M HK$M Interest charged on: Bank loans and overdrafts 158 61 Bonds 559 651 Interest-bearing advances from joint venture companies 16 9 Lease liabilities 19 18 Net fair value (gains)/losses on derivative instruments Cash flow hedges – transferred from other comprehensive income (13) 14 Cross-currency swaps not qualifying as hedges 1 1 Other financing costs 109 131 849 885 Losses on the movement in the fair value of the liability in respect of a put option in favour of the owner of a non-controlling interest 66 64 Capitalised on: Investment properties (370) (293) Properties for sale (186) (49) 359 607 Interest income on: Short-term deposits and bank balances (105) (135) Loans to joint venture and associated companies (51) (79) Others (16) (16) (172) (230) Net finance charges 187 377 The capitalised interest rates on funds both borrowed generally and used for the development of investment properties and properties for sale were between 2.9% and 3.7% per annum (2021: 3.3% and 3.4% per annum). The amount transferred from other comprehensive income in respect of cash flow hedges in 2022 includes HK$12 million (2021: HK$4 million) relating to currency basis. The interest rates per annum (after cross-currency swaps) at 31st December were as follows: 2022 2021 HKD USD HKD USD % % % % Long-term loans and bonds 2.3-5.7 5.1-5.2 0.8-4.4 0.8-2.9 86

2022 Annual Report Page 87 Page 89

2022 Annual Report Page 87 Page 89