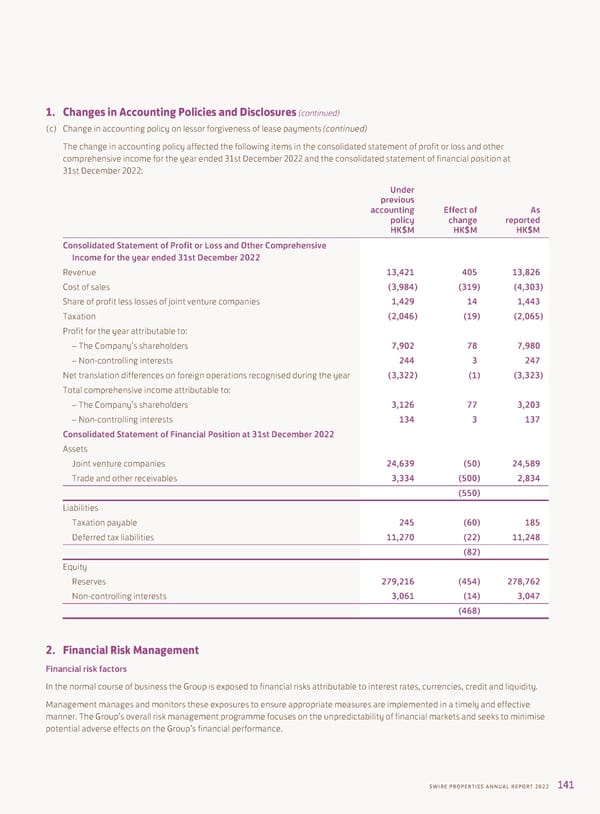

1. Changes in Accounting Policies and Disclosures (continued) (c) Change in accounting policy on lessor forgiveness of lease payments (continued) The change in accounting policy affected the following items in the consolidated statement of profit or loss and other comprehensive income for the year ended 31st December 2022 and the consolidated statement of financial position at 31st December 2022: Under previous accounting Effect of As policy change reported HK$M HK$M HK$M Consolidated Statement of Profit or Loss and Other Comprehensive Income for the year ended 31st December 2022 Revenue 13,421 405 13,826 Cost of sales (3,984) (319) (4,303) Share of profit less losses of joint venture companies 1,429 14 1,443 Taxation (2,046) (19) (2,065) Profit for the year attributable to: – The Company’s shareholders 7,902 78 7,980 – Non-controlling interests 244 3 247 Net translation differences on foreign operations recognised during the year (3,322) (1) (3,323) Total comprehensive income attributable to: – The Company’s shareholders 3,126 77 3,203 – Non-controlling interests 134 3 137 Consolidated Statement of Financial Position at 31st December 2022 Assets Joint venture companies 24,639 (50) 24,589 Trade and other receivables 3,334 (500) 2,834 (550) Liabilities Taxation payable 245 (60) 185 Deferred tax liabilities 11,270 (22) 11,248 (82) Equity Reserves 279,216 (454) 278,762 Non-controlling interests 3,061 (14) 3,047 (468) 2. Financial Risk Management Financial risk factors In the normal course of business the Group is exposed to financial risks attributable to interest rates, currencies, credit and liquidity. Management manages and monitors these exposures to ensure appropriate measures are implemented in a timely and effective manner. The Group’s overall risk management programme focuses on the unpredictability of financial markets and seeks to minimise potential adverse effects on the Group’s financial performance. SWIRE PROPERTIES ANNUAL REPORT 2022 141

2022 Annual Report Page 142 Page 144

2022 Annual Report Page 142 Page 144