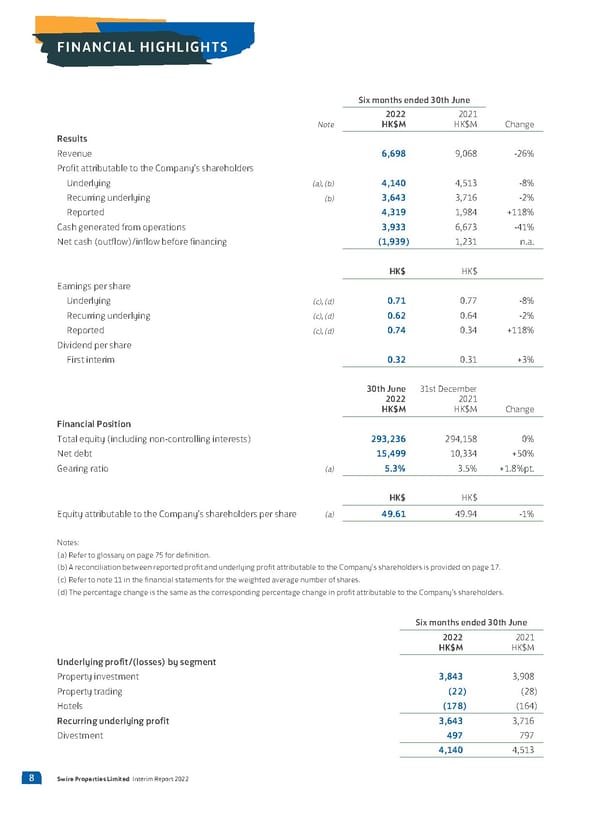

FINANCIAL HIGHLIGHTS Six months ended 30th June 2022 2021 Note HK$M HK$M Change Results Revenue 6,698 9,068 -26% Profit attributable to the Company’s shareholders Underlying (a), (b) 4,140 4,513 -8% Recurring underlying (b) 3,643 3,716 -2% Reported 4,319 1,984 +118% Cash generated from operations 3,933 6,673 -41% Net cash (outflow)/inflow before financing (1,939) 1,231 n.a. HK$ HK$ Earnings per share Underlying (c), (d) 0.71 0.77 -8% Recurring underlying (c), (d) 0.62 0.64 -2% Reported (c), (d) 0.74 0.34 +118% Dividend per share First interim 0.32 0.31 +3% 30th June 31st December 2022 2021 HK$M HK$M Change Financial Position Total equity (including non-controlling interests) 293,236 294,158 0% Net debt 15,499 10,334 +50% Gearing ratio (a) 5.3% 3.5% +1.8%pt. HK$ HK$ Equity attributable to the Company’s shareholders per share (a) 49.61 49.94 -1% Notes: (a) Refer to glossary on page 75 for definition. (b) A reconciliation between reported profit and underlying profit attributable to the Company’s shareholders is provided on page 17. (c) Refer to note 11 in the financial statements for the weighted average number of shares. (d) The percentage change is the same as the corresponding percentage change in profit attributable to the Company’s shareholders. Six months ended 30th June 2022 2021 HK$M HK$M Underlying profit/(losses) by segment Property investment 3,843 3,908 Property trading (22) (28) Hotels (178) (164) Recurring underlying profit 3,643 3,716 Divestment 497 797 4,140 4,513 8 Swire Properties Limited Interim Report 2022

2022 Interim Report | EN Page 9 Page 11

2022 Interim Report | EN Page 9 Page 11