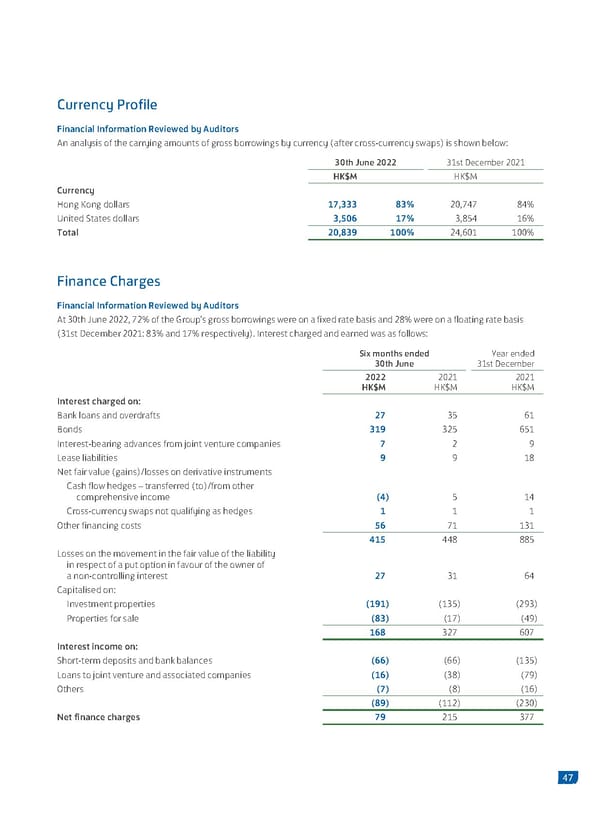

Currency Profile Financial Information Reviewed by Auditors An analysis of the carrying amounts of gross borrowings by currency (after cross-currency swaps) is shown below: 30th June 2022 31st December 2021 HK$M HK$M Currency Hong Kong dollars 17,333 83% 20,747 84% United States dollars 3,506 17% 3,854 16% Total 20,839 100% 24,601 100% Finance Charges Financial Information Reviewed by Auditors At 30th June 2022, 72% of the Group’s gross borrowings were on a fixed rate basis and 28% were on a floating rate basis (31st December 2021: 83% and 17% respectively). Interest charged and earned was as follows: Six months ended Year ended 30th June 31st December 2022 2021 2021 HK$M HK$M HK$M Interest charged on: Bank loans and overdrafts 27 35 61 Bonds 319 325 651 Interest-bearing advances from joint venture companies 7 2 9 Lease liabilities 9 9 18 Net fair value (gains)/losses on derivative instruments Cash flow hedges – transferred (to)/from other comprehensive income (4) 5 14 Cross-currency swaps not qualifying as hedges 1 1 1 Other financing costs 56 71 131 415 448 885 Losses on the movement in the fair value of the liability in respect of a put option in favour of the owner of a non-controlling interest 27 31 64 Capitalised on: Investment properties (191) (135) (293) Properties for sale (83) (17) (49) 168 327 607 Interest income on: Short-term deposits and bank balances (66) (66) (135) Loans to joint venture and associated companies (16) (38) (79) Others (7) (8) (16) (89) (112) (230) Net finance charges 79 215 377 47

2022 Interim Report | EN Page 48 Page 50

2022 Interim Report | EN Page 48 Page 50