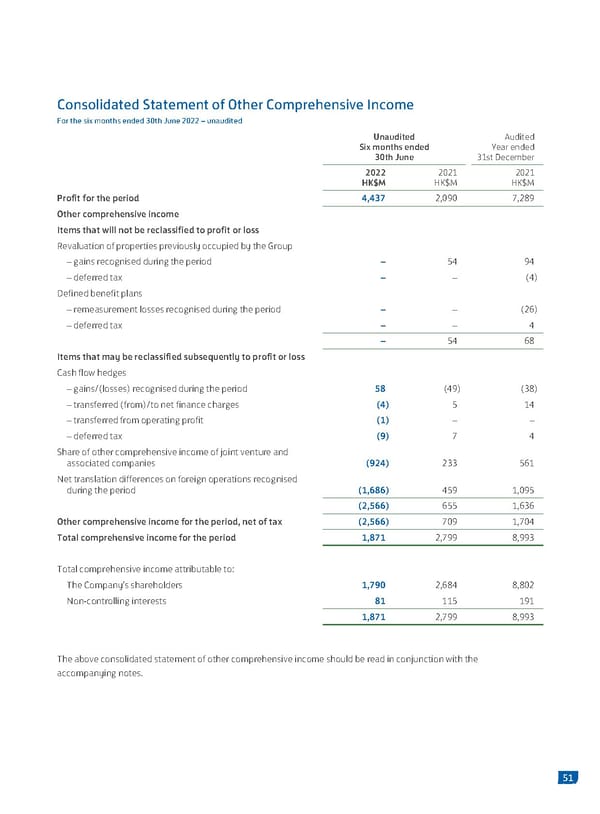

Consolidated Statement of Other Comprehensive Income For the six months ended 30th June 2022 – unaudited Unaudited Audited Six months ended Year ended 30th June 31st December 2022 2021 2021 HK$M HK$M HK$M Profit for the period 4,437 2,090 7,289 Other comprehensive income Items that will not be reclassified to profit or loss Revaluation of properties previously occupied by the Group – gains recognised during the period – 54 94 – deferred tax – – (4) Defined benefit plans – remeasurement losses recognised during the period – – (26) – deferred tax – – 4 – 54 68 Items that may be reclassified subsequently to profit or loss Cash flow hedges – gains/(losses) recognised during the period 58 (49) (38) – transferred (from)/to net finance charges (4) 5 14 – transferred from operating profit (1) – – – deferred tax (9) 7 4 Share of other comprehensive income of joint venture and associated companies (924) 233 561 Net translation differences on foreign operations recognised during the period (1,686) 459 1,095 (2,566) 655 1,636 Other comprehensive income for the period, net of tax (2,566) 709 1,704 Total comprehensive income for the period 1,871 2,799 8,993 Total comprehensive income attributable to: The Company’s shareholders 1,790 2,684 8,802 Non-controlling interests 81 115 191 1,871 2,799 8,993 The above consolidated statement of other comprehensive income should be read in conjunction with the accompanying notes. 51

2022 Interim Report | EN Page 52 Page 54

2022 Interim Report | EN Page 52 Page 54