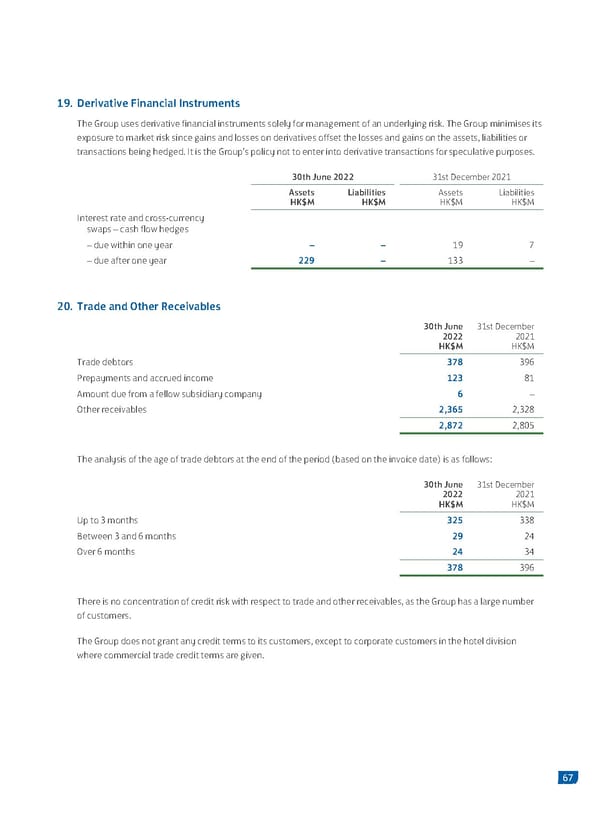

19. Derivative Financial Instruments The Group uses derivative financial instruments solely for management of an underlying risk. The Group minimises its exposure to market risk since gains and losses on derivatives offset the losses and gains on the assets, liabilities or transactions being hedged. It is the Group’s policy not to enter into derivative transactions for speculative purposes. 30th June 2022 31st December 2021 Assets Liabilities Assets Liabilities HK$M HK$M HK$M HK$M Interest rate and cross-currency swaps – cash flow hedges – due within one year – – 19 7 – due after one year 229 – 133 – 20. Trade and Other Receivables 30th June 31st December 2022 2021 HK$M HK$M Trade debtors 378 396 Prepayments and accrued income 123 81 Amount due from a fellow subsidiary company 6 – Other receivables 2,365 2,328 2,872 2,805 The analysis of the age of trade debtors at the end of the period (based on the invoice date) is as follows: 30th June 31st December 2022 2021 HK$M HK$M Up to 3 months 325 338 Between 3 and 6 months 29 24 Over 6 months 24 34 378 396 There is no concentration of credit risk with respect to trade and other receivables, as the Group has a large number of customers. The Group does not grant any credit terms to its customers, except to corporate customers in the hotel division where commercial trade credit terms are given. 67

2022 Interim Report | EN Page 68 Page 70

2022 Interim Report | EN Page 68 Page 70