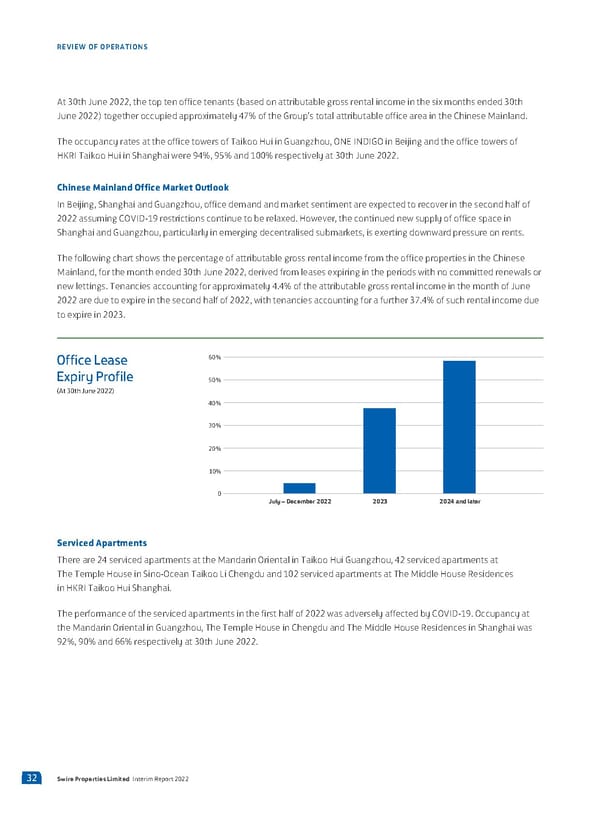

REVIEW OF OPERATIONS At 30th June 2022, the top ten office tenants (based on attributable gross rental income in the six months ended 30th June 2022) together occupied approximately 47% of the Group’s total attributable office area in the Chinese Mainland. The occupancy rates at the office towers of Taikoo Hui in Guangzhou, ONE INDIGO in Beijing and the office towers of HKRI Taikoo Hui in Shanghai were 94%, 95% and 100% respectively at 30th June 2022. Chinese Mainland Office Market Outlook In Beijing, Shanghai and Guangzhou, office demand and market sentiment are expected to recover in the second half of 2022 assuming COVID-19 restrictions continue to be relaxed. However, the continued new supply of office space in Shanghai and Guangzhou, particularly in emerging decentralised submarkets, is exerting downward pressure on rents. The following chart shows the percentage of attributable gross rental income from the office properties in the Chinese Mainland, for the month ended 30th June 2022, derived from leases expiring in the periods with no committed renewals or new lettings. Tenancies accounting for approximately 4.4% of the attributable gross rental income in the month of June 2022 are due to expire in the second half of 2022, with tenancies accounting for a further 37.4% of such rental income due to expire in 2023. Office Lease 60% Expiry Profile 50% (At 30th Jue 2022 40% 30% 20% 10% 0 July – December 2022 2023 2024 and later Serviced Apartments There are 24 serviced apartments at the Mandarin Oriental in Taikoo Hui Guangzhou, 42 serviced apartments at The Temple House in Sino-Ocean Taikoo Li Chengdu and 102 serviced apartments at The Middle House Residences in HKRI Taikoo Hui Shanghai. The performance of the serviced apartments in the first half of 2022 was adversely affected by COVID-19. Occupancy at the Mandarin Oriental in Guangzhou, The Temple House in Chengdu and The Middle House Residences in Shanghai was 92%, 90% and 66% respectively at 30th June 2022. 32 Swire Properties Limited Interim Report 2022

2022 Interim Report | EN Page 33 Page 35

2022 Interim Report | EN Page 33 Page 35