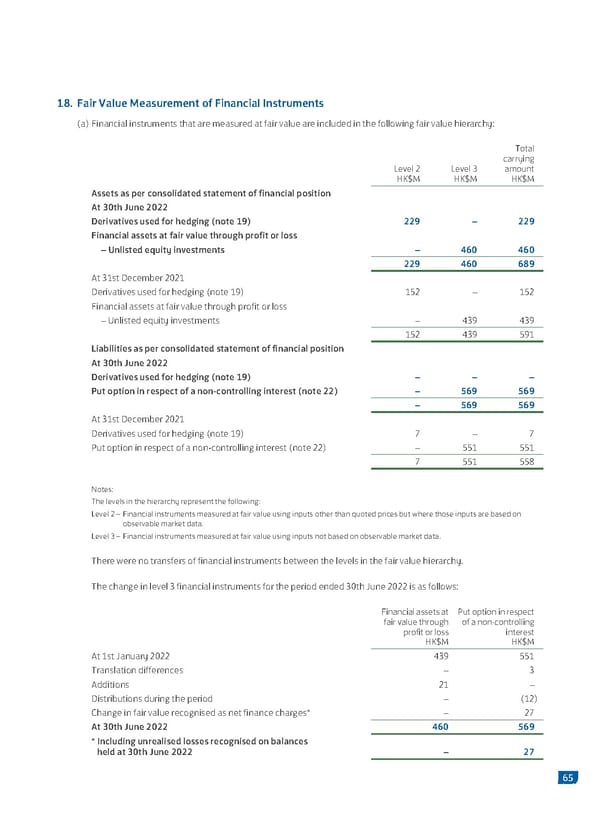

18. Fair Value Measurement of Financial Instruments (a) Financial instruments that are measured at fair value are included in the following fair value hierarchy: Total carrying Level 2 Level 3 amount HK$M HK$M HK$M Assets as per consolidated statement of financial position At 30th June 2022 Derivatives used for hedging (note 19) 229 – 229 Financial assets at fair value through profit or loss – Unlisted equity investments – 460 460 229 460 689 At 31st December 2021 Derivatives used for hedging (note 19) 152 – 152 Financial assets at fair value through profit or loss – Unlisted equity investments – 439 439 152 439 591 Liabilities as per consolidated statement of financial position At 30th June 2022 Derivatives used for hedging (note 19) – – – Put option in respect of a non-controlling interest (note 22) – 569 569 – 569 569 At 31st December 2021 Derivatives used for hedging (note 19) 7 – 7 Put option in respect of a non-controlling interest (note 22) – 551 551 7 551 558 Notes: The levels in the hierarchy represent the following: Level 2 – Financial instruments measured at fair value using inputs other than quoted prices but where those inputs are based on observable market data. Level 3 – Financial instruments measured at fair value using inputs not based on observable market data. There were no transfers of financial instruments between the levels in the fair value hierarchy. The change in level 3 financial instruments for the period ended 30th June 2022 is as follows: Financial assets at Put option in respect fair value through of a non-controlling profit or loss interest HK$M HK$M At 1st January 2022 439 551 Translation differences – 3 Additions 21 – Distributions during the period – (12) Change in fair value recognised as net finance charges* – 27 At 30th June 2022 460 569 * Including unrealised losses recognised on balances held at 30th June 2022 – 27 65

2022 Interim Report | EN Page 66 Page 68

2022 Interim Report | EN Page 66 Page 68