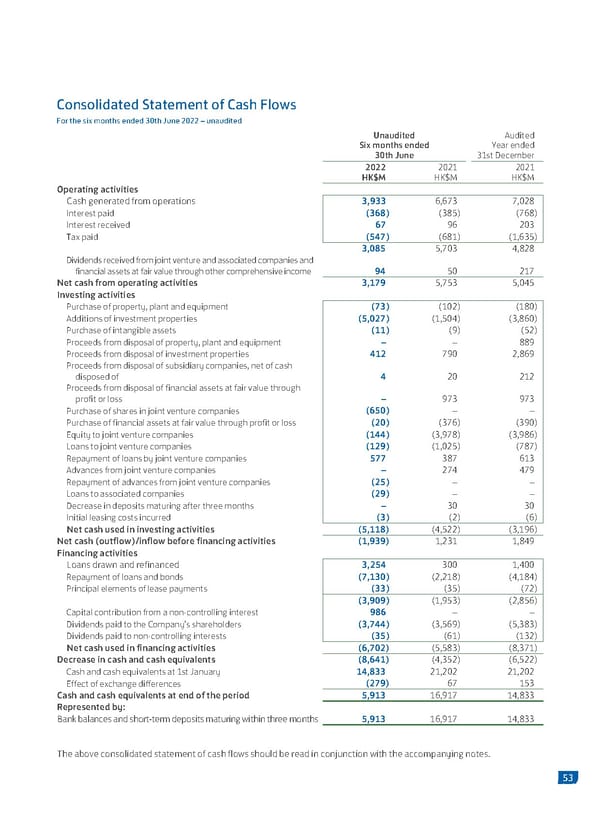

Consolidated Statement of Cash Flows For the six months ended 30th June 2022 – unaudited Unaudited Audited Six months ended Year ended 30th June 31st December 2022 2021 2021 HK$M HK$M HK$M Operating activities Cash generated from operations 3,933 6,673 7,028 Interest paid (368) (385) (768) Interest received 67 96 203 Tax paid (547) (681) (1,635) 3,085 5,703 4,828 Dividends received from joint venture and associated companies and financial assets at fair value through other comprehensive income 94 50 217 Net cash from operating activities 3,179 5,753 5,045 Investing activities Purchase of property, plant and equipment (73) (102) (180) Additions of investment properties (5,027) (1,504) (3,860) Purchase of intangible assets (11) (9) (52) Proceeds from disposal of property, plant and equipment – – 889 Proceeds from disposal of investment properties 412 790 2,869 Proceeds from disposal of subsidiary companies, net of cash disposed of 4 20 212 Proceeds from disposal of financial assets at fair value through profit or loss – 973 973 Purchase of shares in joint venture companies (650) – – Purchase of financial assets at fair value through profit or loss (20) (376) (390) Equity to joint venture companies (144) (3,978) (3,986) Loans to joint venture companies (129) (1,025) (787) Repayment of loans by joint venture companies 577 387 613 Advances from joint venture companies – 274 479 Repayment of advances from joint venture companies (25) – – Loans to associated companies (29) – – Decrease in deposits maturing after three months – 30 30 Initial leasing costs incurred (3) (2) (6) Net cash used in investing activities (5,118) (4,522) (3,196) Net cash (outflow)/inflow before financing activities (1,939) 1,231 1,849 Financing activities Loans drawn and refinanced 3,254 300 1,400 Repayment of loans and bonds (7,130) (2,218) (4,184) Principal elements of lease payments (33) (35) (72) (3,909) (1,953) (2,856) Capital contribution from a non-controlling interest 986 – – Dividends paid to the Company’s shareholders (3,744) (3,569) (5,383) Dividends paid to non-controlling interests (35) (61) (132) Net cash used in financing activities (6,702) (5,583) (8,371) Decrease in cash and cash equivalents (8,641) (4,352) (6,522) Cash and cash equivalents at 1st January 14,833 21,202 21,202 Effect of exchange differences (279) 67 153 Cash and cash equivalents at end of the period 5,913 16,917 14,833 Represented by: Bank balances and short-term deposits maturing within three months 5,913 16,917 14,833 The above consolidated statement of cash flows should be read in conjunction with the accompanying notes. 53

2022 Interim Report Page 54 Page 56

2022 Interim Report Page 54 Page 56