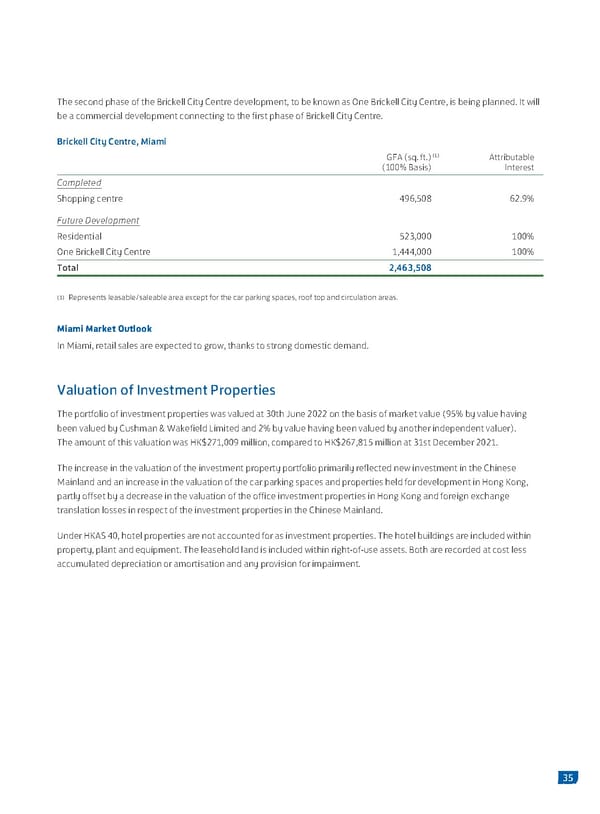

The second phase of the Brickell City Centre development, to be known as One Brickell City Centre, is being planned. It will be a commercial development connecting to the first phase of Brickell City Centre. Brickell City Centre, Miami (1) GFA (sq. ft.) Attributable (100% Basis) Interest Completed Shopping centre 496,508 62.9% Future Development Residential 523,000 100% One Brickell City Centre 1,444,000 100% Total 2,463,508 (1) Represents leasable/saleable area except for the car parking spaces, roof top and circulation areas. Miami Market Outlook In Miami, retail sales are expected to grow, thanks to strong domestic demand. Valuation of Investment Properties The portfolio of investment properties was valued at 30th June 2022 on the basis of market value (95% by value having been valued by Cushman & Wakefield Limited and 2% by value having been valued by another independent valuer). The amount of this valuation was HK$271,009 million, compared to HK$267,815 million at 31st December 2021. The increase in the valuation of the investment property portfolio primarily reflected new investment in the Chinese Mainland and an increase in the valuation of the car parking spaces and properties held for development in Hong Kong, partly offset by a decrease in the valuation of the office investment properties in Hong Kong and foreign exchange translation losses in respect of the investment properties in the Chinese Mainland. Under HKAS 40, hotel properties are not accounted for as investment properties. The hotel buildings are included within property, plant and equipment. The leasehold land is included within right-of-use assets. Both are recorded at cost less accumulated depreciation or amortisation and any provision for impairment. 35

2022 Interim Report Page 36 Page 38

2022 Interim Report Page 36 Page 38