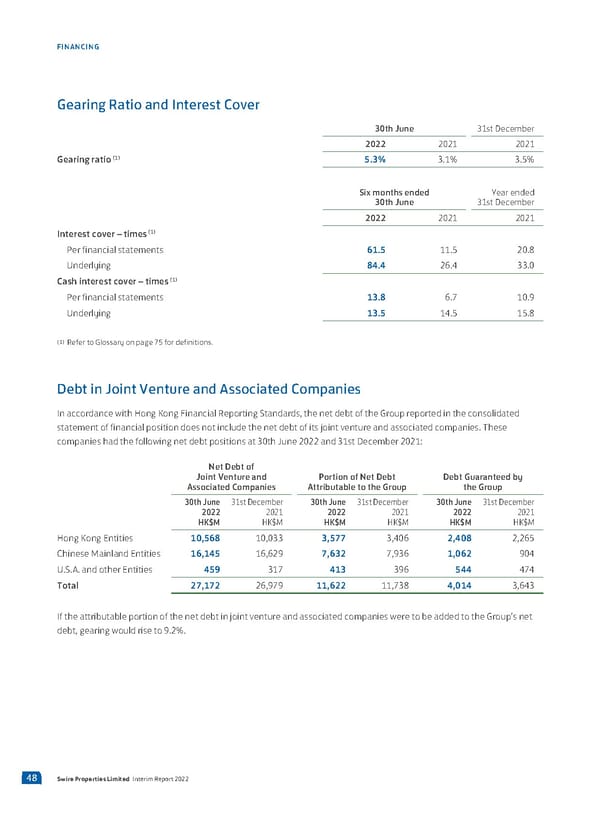

FINANCING Gearing Ratio and Interest Cover 30th June 31st December 2022 2021 2021 (1) Gearing ratio 5.3% 3.1% 3.5% Six months ended Year ended 30th June 31st December 2022 2021 2021 (1) Interest cover – times Per financial statements 61.5 11.5 20.8 Underlying 84.4 26.4 33.0 Cash interest cover – times (1) Per financial statements 13.8 6.7 10.9 Underlying 13.5 14.5 15.8 (1) Refer to Glossary on page 75 for definitions. Debt in Joint Venture and Associated Companies In accordance with Hong Kong Financial Reporting Standards, the net debt of the Group reported in the consolidated statement of financial position does not include the net debt of its joint venture and associated companies. These companies had the following net debt positions at 30th June 2022 and 31st December 2021: Net Debt of Joint Venture and Portion of Net Debt Debt Guaranteed by Associated Companies Attributable to the Group the Group 30th June 31st December 30th June 31st December 30th June 31st December 2022 2021 2022 2021 2022 2021 HK$M HK$M HK$M HK$M HK$M HK$M Hong Kong Entities 10,568 10,033 3,577 3,406 2,408 2,265 Chinese Mainland Entities 16,145 16,629 7,632 7,936 1,062 904 U.S.A. and other Entities 459 317 413 396 544 474 Total 27,172 26,979 11,622 11,738 4,014 3,643 If the attributable portion of the net debt in joint venture and associated companies were to be added to the Group’s net debt, gearing would rise to 9.2%. 48 Swire Properties Limited Interim Report 2022

2022 Interim Report Page 49 Page 51

2022 Interim Report Page 49 Page 51