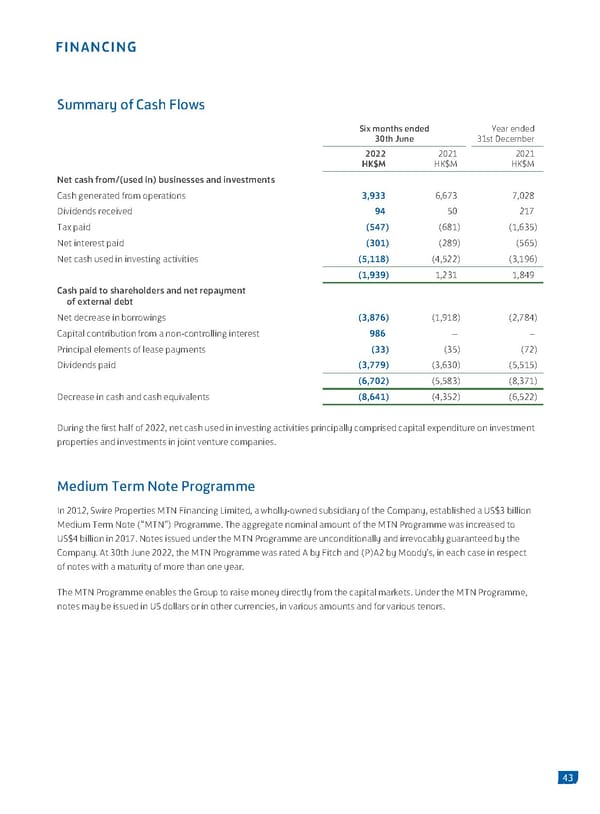

FINANCING Summary of Cash Flows Six months ended Year ended 30th June 31st December 2022 2021 2021 HK$M HK$M HK$M Net cash from/(used in) businesses and investments Cash generated from operations 3,933 6,673 7,028 Dividends received 94 50 217 Tax paid (547) (681) (1,635) Net interest paid (301) (289) (565) Net cash used in investing activities (5,118) (4,522) (3,196) (1,939) 1,231 1,849 Cash paid to shareholders and net repayment of external debt Net decrease in borrowings (3,876) (1,918) (2,784) Capital contribution from a non-controlling interest 986 – – Principal elements of lease payments (33) (35) (72) Dividends paid (3,779) (3,630) (5,515) (6,702) (5,583) (8,371) Decrease in cash and cash equivalents (8,641) (4,352) (6,522) During the first half of 2022, net cash used in investing activities principally comprised capital expenditure on investment properties and investments in joint venture companies. Medium Term Note Programme In 2012, Swire Properties MTN Financing Limited, a wholly-owned subsidiary of the Company, established a US$3 billion Medium Term Note (“MTN”) Programme. The aggregate nominal amount of the MTN Programme was increased to US$4 billion in 2017. Notes issued under the MTN Programme are unconditionally and irrevocably guaranteed by the Company. At 30th June 2022, the MTN Programme was rated A by Fitch and (P)A2 by Moody’s, in each case in respect of notes with a maturity of more than one year. The MTN Programme enables the Group to raise money directly from the capital markets. Under the MTN Programme, notes may be issued in US dollars or in other currencies, in various amounts and for various tenors. 43

2022 Interim Report Page 44 Page 46

2022 Interim Report Page 44 Page 46