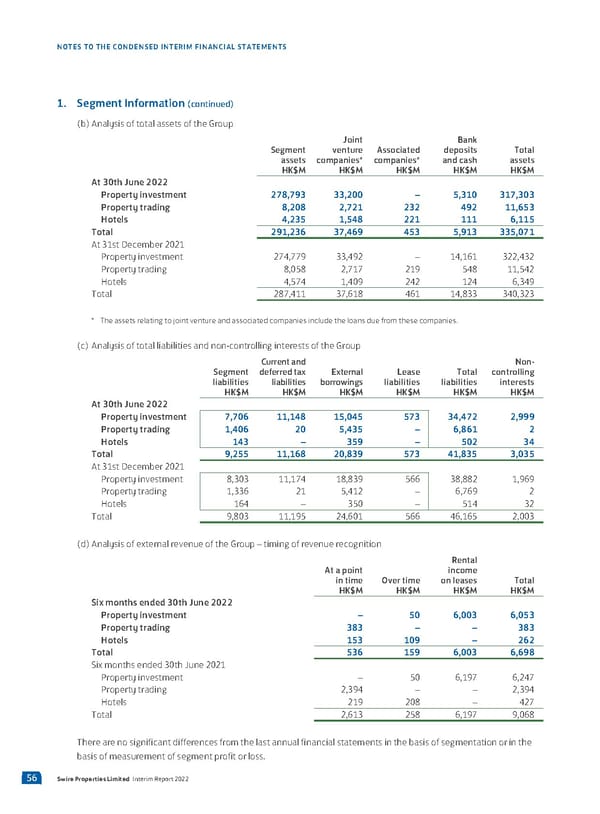

NOTES TO THE CONDENSED INTERIM FINANCIAL STATEMENTS 1. Segment Information (continued) (b) Analysis of total assets of the Group Joint Bank Segment venture Associated deposits Total assets companies* companies* and cash assets HK$M HK$M HK$M HK$M HK$M At 30th June 2022 Property investment 278,793 33,200 – 5,310 317,303 Property trading 8,208 2,721 232 492 11,653 Hotels 4,235 1,548 221 111 6,115 Total 291,236 37,469 453 5,913 335,071 At 31st December 2021 Property investment 274,779 33,492 – 14,161 322,432 Property trading 8,058 2,717 219 548 11,542 Hotels 4,574 1,409 242 124 6,349 Total 287,411 37,618 461 14,833 340,323 * The assets relating to joint venture and associated companies include the loans due from these companies. (c) Analysis of total liabilities and non-controlling interests of the Group Current and Non- Segment deferred tax External Lease Total controlling liabilities liabilities borrowings liabilities liabilities interests HK$M HK$M HK$M HK$M HK$M HK$M At 30th June 2022 Property investment 7,706 11,148 15,045 573 34,472 2,999 Property trading 1,406 20 5,435 – 6,861 2 Hotels 143 – 359 – 502 34 Total 9,255 11,168 20,839 573 41,835 3,035 At 31st December 2021 Property investment 8,303 11,174 18,839 566 38,882 1,969 Property trading 1,336 21 5,412 – 6,769 2 Hotels 164 – 350 – 514 32 Total 9,803 11,195 24,601 566 46,165 2,003 (d) Analysis of external revenue of the Group – timing of revenue recognition Rental At a point income in time Over time on leases Total HK$M HK$M HK$M HK$M Six months ended 30th June 2022 Property investment – 50 6,003 6,053 Property trading 383 – – 383 Hotels 153 109 – 262 Total 536 159 6,003 6,698 Six months ended 30th June 2021 Property investment – 50 6,197 6,247 Property trading 2,394 – – 2,394 Hotels 219 208 – 427 Total 2,613 258 6,197 9,068 There are no significant differences from the last annual financial statements in the basis of segmentation or in the basis of measurement of segment profit or loss. 56 Swire Properties Limited Interim Report 2022

2022 Interim Report Page 57 Page 59

2022 Interim Report Page 57 Page 59