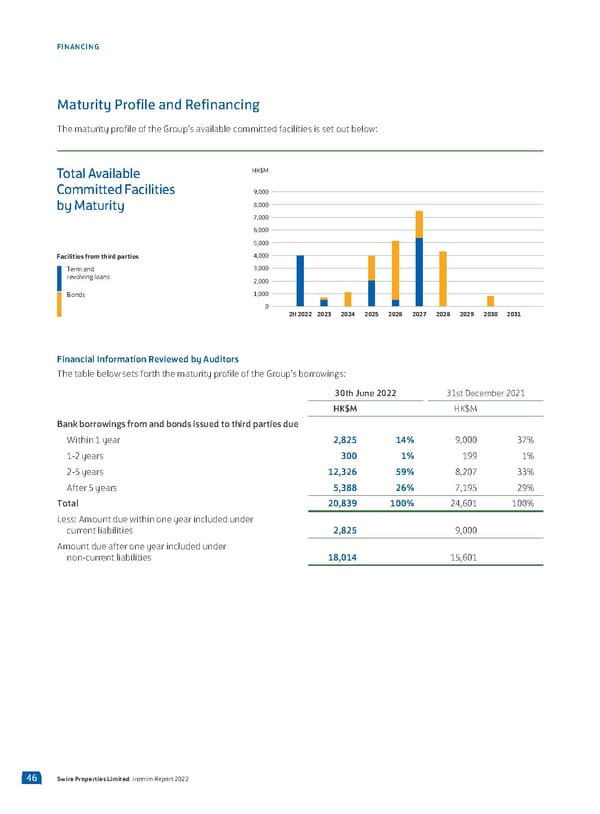

FINANCING Maturity Profile and Refinancing The maturity profile of the Group’s available committed facilities is set out below: Total Available M Committed Facilities 9,000 by Matuity 8,000 7,000 6,000 5,000 Facilities from third parties 4,000 Tem ad 3,000 evolvi loas 2,000 ods 1,000 0 2H 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 Financial Information Reviewed by Auditors The table below sets forth the maturity profile of the Group’s borrowings: 30th June 2022 31st December 2021 HK$M HK$M Bank borrowings from and bonds issued to third parties due Within 1 year 2,825 14% 9,000 37% 1-2 years 300 1% 199 1% 2-5 years 12,326 59% 8,207 33% After 5 years 5,388 26% 7,195 29% Total 20,839 100% 24,601 100% Less: Amount due within one year included under current liabilities 2,825 9,000 Amount due after one year included under non-current liabilities 18,014 15,601 46 Swire Properties Limited Interim Report 2022

2022 Interim Report Page 47 Page 49

2022 Interim Report Page 47 Page 49