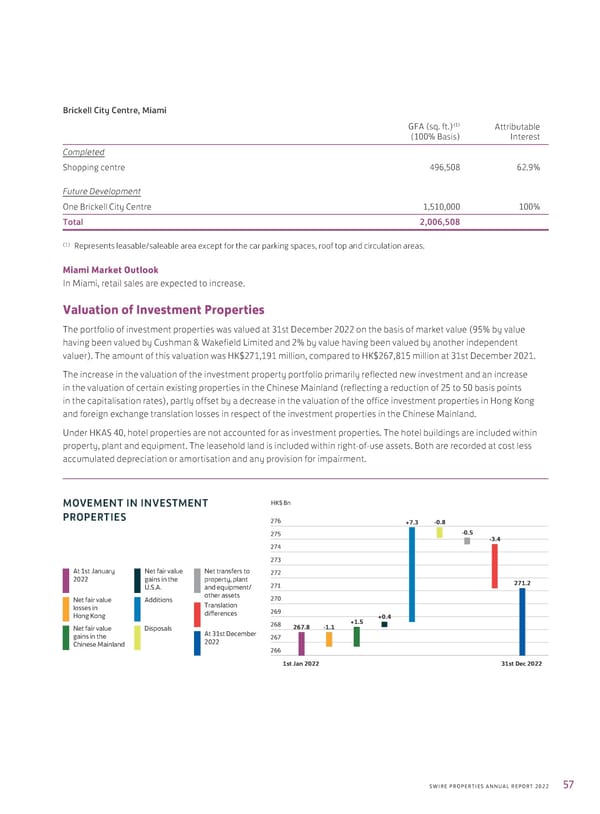

Brickell City Centre, Miami (1) GFA (sq. ft.) Attributable (100% Basis) Interest Completed Shopping centre 496,508 62.9% Future Development One Brickell City Centre 1,510,000 100% Total 2,006,508 (1) Represents leasable/saleable area except for the car parking spaces, roof top and circulation areas. Miami Market Outlook In Miami, retail sales are expected to increase. Valuation of Investment Properties The portfolio of investment properties was valued at 31st December 2022 on the basis of market value (95% by value having been valued by Cushman & Wakefield Limited and 2% by value having been valued by another independent valuer). The amount of this valuation was HK$271,191 million, compared to HK$267,815 million at 31st December 2021. The increase in the valuation of the investment property portfolio primarily reflected new investment and an increase in the valuation of certain existing properties in the Chinese Mainland (reflecting a reduction of 25 to 50 basis points in the capitalisation rates), partly offset by a decrease in the valuation of the office investment properties in Hong Kong and foreign exchange translation losses in respect of the investment properties in the Chinese Mainland. Under HKAS 40, hotel properties are not accounted for as investment properties. The hotel buildings are included within property, plant and equipment. The leasehold land is included within right-of-use assets. Both are recorded at cost less accumulated depreciation or amortisation and any provision for impairment. MOVEMENT IN INVESTMENT HK$ Bn PROPERTIES 276 +7.3 -0.8 275 -0.5 -3.4 274 273 At 1st January Net fair value Net transfers to 272 2022 ains in te ‚ro‚ertyƒ ‚lant 271 271.2 A an e„ui‚…ent† Net fair value Aitions oter assets 270 losses in ‡ranslation 269 Hon Kon ifferenˆes +0.4 Net fair value €is‚osals 268 267.8 -1.1 +1.5 ains in te At 31st €eˆe…‰er 267 inese ainlan 2022 266 1st Jan 2022 31st Dec 2022 SWIRE PROPERTIES ANNUAL REPORT 2022 57

Annual Report 2022 Page 58 Page 60

Annual Report 2022 Page 58 Page 60