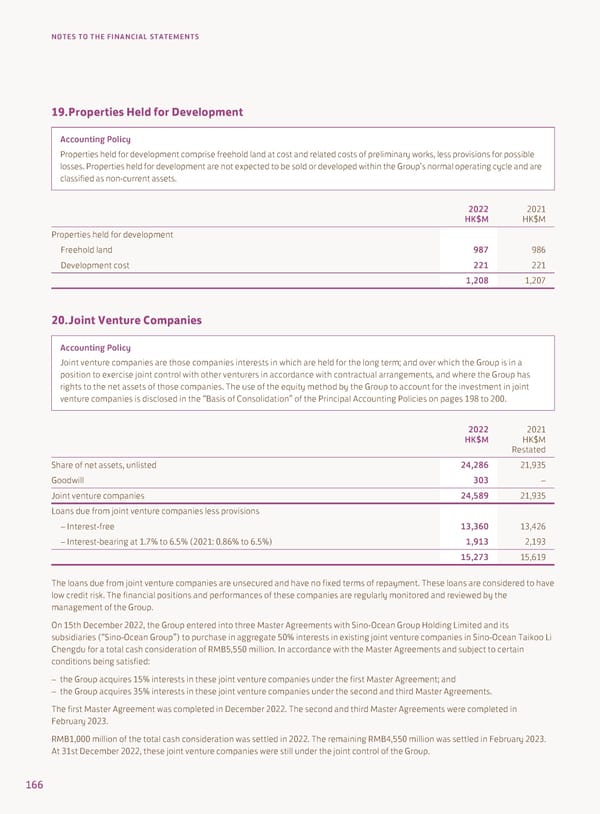

NOTES TO THE FINANCIAL STATEMENTS 19. Properties Held for Development Accounting Policy Properties held for development comprise freehold land at cost and related costs of preliminary works, less provisions for possible losses. Properties held for development are not expected to be sold or developed within the Group’s normal operating cycle and are classified as non-current assets. 2022 2021 HK$M HK$M Properties held for development Freehold land 987 986 Development cost 221 221 1,208 1,207 20. Joint Venture Companies Accounting Policy Joint venture companies are those companies interests in which are held for the long term; and over which the Group is in a position to exercise joint control with other venturers in accordance with contractual arrangements, and where the Group has rights to the net assets of those companies. The use of the equity method by the Group to account for the investment in joint venture companies is disclosed in the “Basis of Consolidation” of the Principal Accounting Policies on pages 198 to 200. 2022 2021 HK$M HK$M Restated Share of net assets, unlisted 24,286 21,935 Goodwill 303 – Joint venture companies 24,589 21,935 Loans due from joint venture companies less provisions – Interest-free 13,360 13,426 – Interest-bearing at 1.7% to 6.5% (2021: 0.86% to 6.5%) 1,913 2,193 15,273 15,619 The loans due from joint venture companies are unsecured and have no fixed terms of repayment. These loans are considered to have low credit risk. The financial positions and performances of these companies are regularly monitored and reviewed by the management of the Group. On 15th December 2022, the Group entered into three Master Agreements with Sino-Ocean Group Holding Limited and its subsidiaries (“Sino-Ocean Group”) to purchase in aggregate 50% interests in existing joint venture companies in Sino-Ocean Taikoo Li Chengdu for a total cash consideration of RMB5,550 million. In accordance with the Master Agreements and subject to certain conditions being satisfied: – the Group acquires 15% interests in these joint venture companies under the first Master Agreement; and – the Group acquires 35% interests in these joint venture companies under the second and third Master Agreements. The first Master Agreement was completed in December 2022. The second and third Master Agreements were completed in February 2023. RMB1,000 million of the total cash consideration was settled in 2022. The remaining RMB4,550 million was settled in February 2023. At 31st December 2022, these joint venture companies were still under the joint control of the Group. 166

Annual Report 2022 Page 167 Page 169

Annual Report 2022 Page 167 Page 169