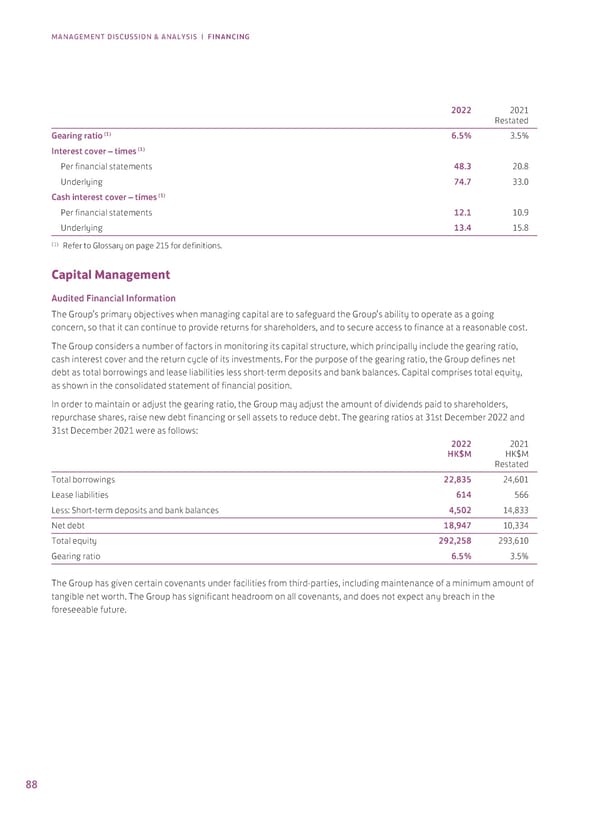

MANAGEMENT DISCUSSION & ANALYSIS | FINANCING 2022 2021 Restated Gearing ratio (1) 6.5% 3.5% (1) Interest cover – times Per financial statements 48.3 20.8 Underlying 74.7 33.0 (1) Cash interest cover – times Per financial statements 12.1 10.9 Underlying 13.4 15.8 (1) Refer to Glossary on page 215 for definitions. Capital Management Audited Financial Information The Group’s primary objectives when managing capital are to safeguard the Group’s ability to operate as a going concern, so that it can continue to provide returns for shareholders, and to secure access to finance at a reasonable cost. The Group considers a number of factors in monitoring its capital structure, which principally include the gearing ratio, cash interest cover and the return cycle of its investments. For the purpose of the gearing ratio, the Group defines net debt as total borrowings and lease liabilities less short-term deposits and bank balances. Capital comprises total equity, as shown in the consolidated statement of financial position. In order to maintain or adjust the gearing ratio, the Group may adjust the amount of dividends paid to shareholders, repurchase shares, raise new debt financing or sell assets to reduce debt. The gearing ratios at 31st December 2022 and 31st December 2021 were as follows: 2022 2021 HK$M HK$M Restated Total borrowings 22,835 24,601 Lease liabilities 614 566 Less: Short-term deposits and bank balances 4,502 14,833 Net debt 18,947 10,334 Total equity 292,258 293,610 Gearing ratio 6.5% 3.5% The Group has given certain covenants under facilities from third-parties, including maintenance of a minimum amount of tangible net worth. The Group has significant headroom on all covenants, and does not expect any breach in the foreseeable future. 88

Annual Report 2022 Page 89 Page 91

Annual Report 2022 Page 89 Page 91