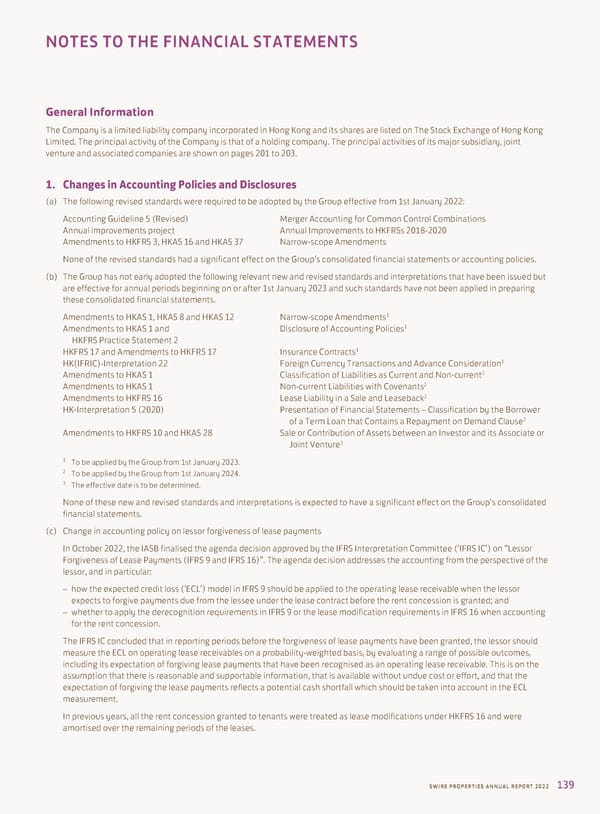

NOTES TO THE FINANCIAL STATEMENTS General Information The Company is a limited liability company incorporated in Hong Kong and its shares are listed on The Stock Exchange of Hong Kong Limited. The principal activity of the Company is that of a holding company. The principal activities of its major subsidiary, joint venture and associated companies are shown on pages 201 to 203. 1. Changes in Accounting Policies and Disclosures (a) The following revised standards were required to be adopted by the Group effective from 1st January 2022: Accounting Guideline 5 (Revised) Merger Accounting for Common Control Combinations Annual improvements project Annual Improvements to HKFRSs 2018-2020 Amendments to HKFRS 3, HKAS 16 and HKAS 37 Narrow-scope Amendments None of the revised standards had a significant effect on the Group’s consolidated financial statements or accounting policies. (b) The Group has not early adopted the following relevant new and revised standards and interpretations that have been issued but are effective for annual periods beginning on or after 1st January 2023 and such standards have not been applied in preparing these consolidated financial statements. 1 Amendments to HKAS 1, HKAS 8 and HKAS 12 Narrow-scope Amendments 1 Amendments to HKAS 1 and Disclosure of Accounting Policies HKFRS Practice Statement 2 HKFRS 17 and Amendments to HKFRS 17 Insurance Contracts1 1 HK(IFRIC)-Interpretation 22 Foreign Currency Transactions and Advance Consideration 2 Amendments to HKAS 1 Classification of Liabilities as Current and Non-current 2 Amendments to HKAS 1 Non-current Liabilities with Covenants 2 Amendments to HKFRS 16 Lease Liability in a Sale and Leaseback HK-Interpretation 5 (2020) Presentation of Financial Statements – Classification by the Borrower 2 of a Term Loan that Contains a Repayment on Demand Clause Amendments to HKFRS 10 and HKAS 28 Sale or Contribution of Assets between an Investor and its Associate or 3 Joint Venture 1 To be applied by the Group from 1st January 2023. 2 To be applied by the Group from 1st January 2024. 3 The effective date is to be determined. None of these new and revised standards and interpretations is expected to have a significant effect on the Group’s consolidated financial statements. (c) Change in accounting policy on lessor forgiveness of lease payments In October 2022, the IASB finalised the agenda decision approved by the IFRS Interpretation Committee (‘IFRS IC’) on “Lessor Forgiveness of Lease Payments (IFRS 9 and IFRS 16)”. The agenda decision addresses the accounting from the perspective of the lessor, and in particular: – how the expected credit loss (‘ECL’) model in IFRS 9 should be applied to the operating lease receivable when the lessor expects to forgive payments due from the lessee under the lease contract before the rent concession is granted; and – whether to apply the derecognition requirements in IFRS 9 or the lease modification requirements in IFRS 16 when accounting for the rent concession. The IFRS IC concluded that in reporting periods before the forgiveness of lease payments have been granted, the lessor should measure the ECL on operating lease receivables on a probability-weighted basis, by evaluating a range of possible outcomes, including its expectation of forgiving lease payments that have been recognised as an operating lease receivable. This is on the assumption that there is reasonable and supportable information, that is available without undue cost or effort, and that the expectation of forgiving the lease payments reflects a potential cash shortfall which should be taken into account in the ECL measurement. In previous years, all the rent concession granted to tenants were treated as lease modifications under HKFRS 16 and were amortised over the remaining periods of the leases. SWIRE PROPERTIES ANNUAL REPORT 2022 SWIRE PROPERTIES ANNUAL REPORT 2022 139

Annual Report 2022 Page 140 Page 142

Annual Report 2022 Page 140 Page 142