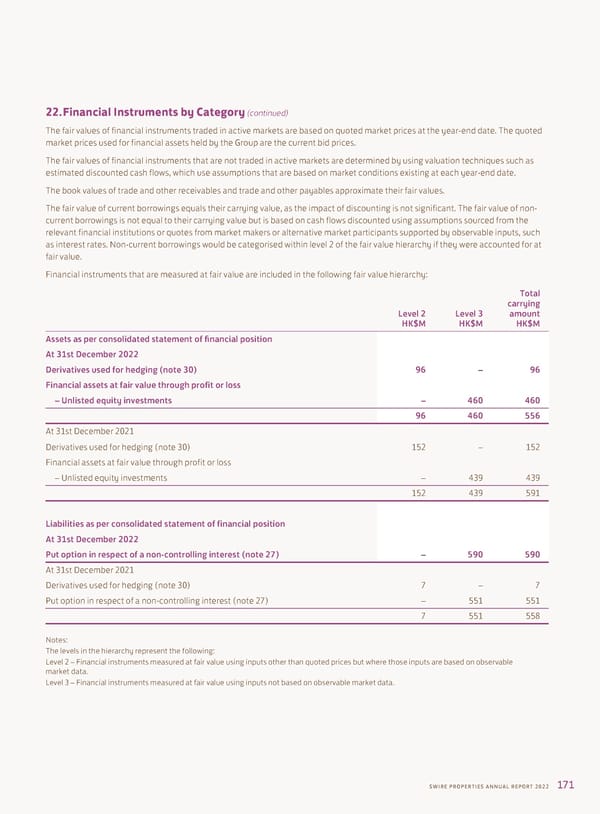

22. Financial Instruments by Category (continued) The fair values of financial instruments traded in active markets are based on quoted market prices at the year-end date. The quoted market prices used for financial assets held by the Group are the current bid prices. The fair values of financial instruments that are not traded in active markets are determined by using valuation techniques such as estimated discounted cash flows, which use assumptions that are based on market conditions existing at each year-end date. The book values of trade and other receivables and trade and other payables approximate their fair values. The fair value of current borrowings equals their carrying value, as the impact of discounting is not significant. The fair value of non- current borrowings is not equal to their carrying value but is based on cash flows discounted using assumptions sourced from the relevant financial institutions or quotes from market makers or alternative market participants supported by observable inputs, such as interest rates. Non-current borrowings would be categorised within level 2 of the fair value hierarchy if they were accounted for at fair value. Financial instruments that are measured at fair value are included in the following fair value hierarchy: Total carrying Level 2 Level 3 amount HK$M HK$M HK$M Assets as per consolidated statement of financial position At 31st December 2022 Derivatives used for hedging (note 30) 96 – 96 Financial assets at fair value through profit or loss – Unlisted equity investments – 460 460 96 460 556 At 31st December 2021 Derivatives used for hedging (note 30) 152 – 152 Financial assets at fair value through profit or loss – Unlisted equity investments – 439 439 152 439 591 Liabilities as per consolidated statement of financial position At 31st December 2022 Put option in respect of a non-controlling interest (note 27) – 590 590 At 31st December 2021 Derivatives used for hedging (note 30) 7 – 7 Put option in respect of a non-controlling interest (note 27) – 551 551 7 551 558 Notes: The levels in the hierarchy represent the following: Level 2 – Financial instruments measured at fair value using inputs other than quoted prices but where those inputs are based on observable market data. Level 3 – Financial instruments measured at fair value using inputs not based on observable market data. SWIRE PROPERTIES ANNUAL REPORT 2022 171

Annual Report 2022 Page 172 Page 174

Annual Report 2022 Page 172 Page 174