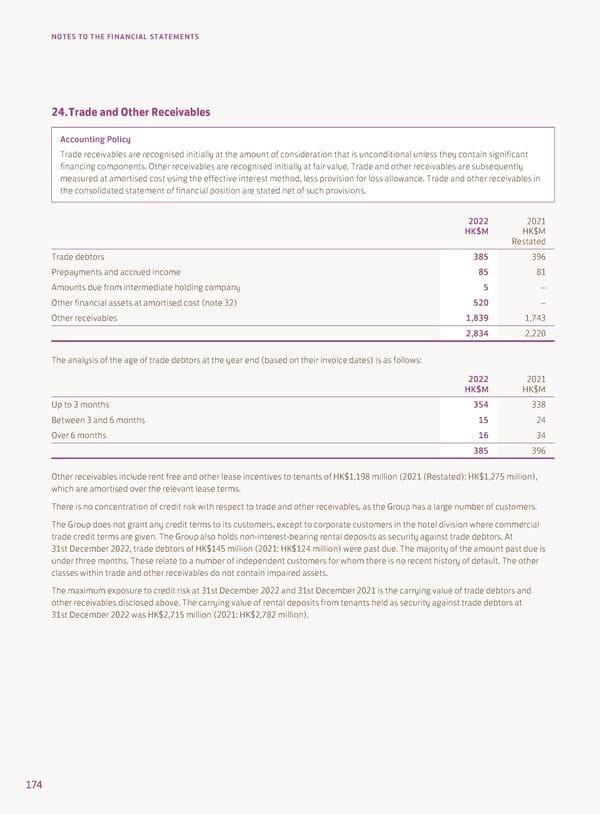

NOTES TO THE FINANCIAL STATEMENTS 24. Trade and Other Receivables Accounting Policy Trade receivables are recognised initially at the amount of consideration that is unconditional unless they contain significant financing components. Other receivables are recognised initially at fair value. Trade and other receivables are subsequently measured at amortised cost using the effective interest method, less provision for loss allowance. Trade and other receivables in the consolidated statement of financial position are stated net of such provisions. 2022 2021 HK$M HK$M Restated Trade debtors 385 396 Prepayments and accrued income 85 81 Amounts due from intermediate holding company 5 – Other financial assets at amortised cost (note 32) 520 – Other receivables 1,839 1,743 2,834 2,220 The analysis of the age of trade debtors at the year end (based on their invoice dates) is as follows: 2022 2021 HK$M HK$M Up to 3 months 354 338 Between 3 and 6 months 15 24 Over 6 months 16 34 385 396 Other receivables include rent free and other lease incentives to tenants of HK$1,198 million (2021 (Restated): HK$1,275 million), which are amortised over the relevant lease terms. There is no concentration of credit risk with respect to trade and other receivables, as the Group has a large number of customers. The Group does not grant any credit terms to its customers, except to corporate customers in the hotel division where commercial trade credit terms are given. The Group also holds non-interest-bearing rental deposits as security against trade debtors. At 31st December 2022, trade debtors of HK$145 million (2021: HK$124 million) were past due. The majority of the amount past due is under three months. These relate to a number of independent customers for whom there is no recent history of default. The other classes within trade and other receivables do not contain impaired assets. The maximum exposure to credit risk at 31st December 2022 and 31st December 2021 is the carrying value of trade debtors and other receivables disclosed above. The carrying value of rental deposits from tenants held as security against trade debtors at 31st December 2022 was HK$2,715 million (2021: HK$2,782 million). 174

Annual Report 2022 Page 175 Page 177

Annual Report 2022 Page 175 Page 177