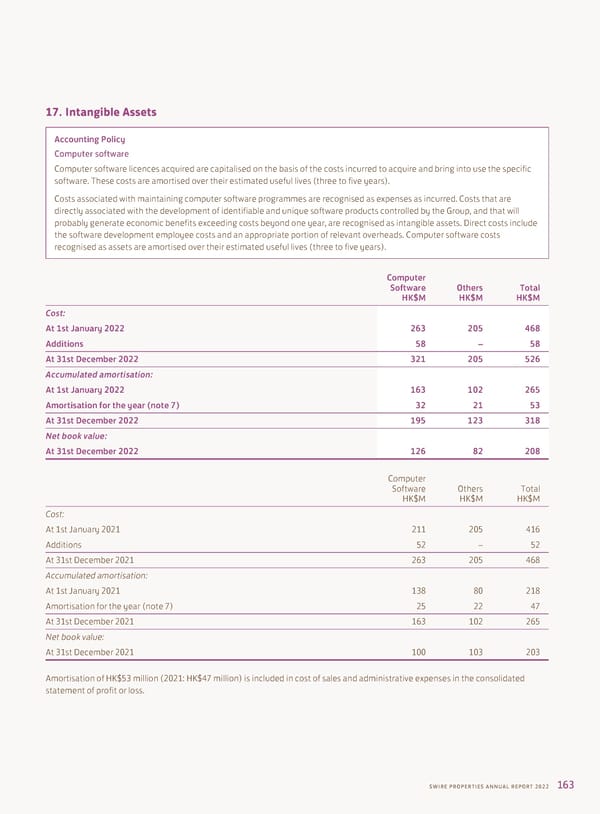

17. Intangible Assets Accounting Policy Computer software Computer software licences acquired are capitalised on the basis of the costs incurred to acquire and bring into use the specific software. These costs are amortised over their estimated useful lives (three to five years). Costs associated with maintaining computer software programmes are recognised as expenses as incurred. Costs that are directly associated with the development of identifiable and unique software products controlled by the Group, and that will probably generate economic benefits exceeding costs beyond one year, are recognised as intangible assets. Direct costs include the software development employee costs and an appropriate portion of relevant overheads. Computer software costs recognised as assets are amortised over their estimated useful lives (three to five years). Computer Software Others Total HK$M HK$M HK$M Cost: At 1st January 2022 263 205 468 Additions 58 – 58 At 31st December 2022 321 205 526 Accumulated amortisation: At 1st January 2022 163 102 265 Amortisation for the year (note 7) 32 21 53 At 31st December 2022 195 123 318 Net book value: At 31st December 2022 126 82 208 Computer Software Others Total HK$M HK$M HK$M Cost: At 1st January 2021 211 205 416 Additions 52 – 52 At 31st December 2021 263 205 468 Accumulated amortisation: At 1st January 2021 138 80 218 Amortisation for the year (note 7) 25 22 47 At 31st December 2021 163 102 265 Net book value: At 31st December 2021 100 103 203 Amortisation of HK$53 million (2021: HK$47 million) is included in cost of sales and administrative expenses in the consolidated statement of profit or loss. SWIRE PROPERTIES ANNUAL REPORT 2022 163

Annual Report 2022 Page 164 Page 166

Annual Report 2022 Page 164 Page 166