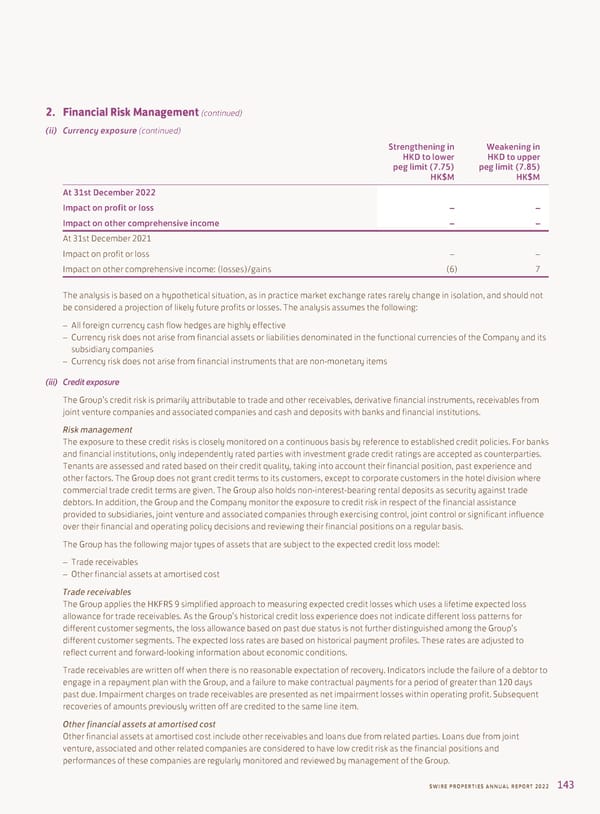

2. Financial Risk Management (continued) (ii) Currency exposure (continued) Strengthening in Weakening in HKD to lower HKD to upper peg limit (7.75) peg limit (7.85) HK$M HK$M At 31st December 2022 Impact on profit or loss – – Impact on other comprehensive income – – At 31st December 2021 Impact on profit or loss – – Impact on other comprehensive income: (losses)/gains (6) 7 The analysis is based on a hypothetical situation, as in practice market exchange rates rarely change in isolation, and should not be considered a projection of likely future profits or losses. The analysis assumes the following: – All foreign currency cash flow hedges are highly effective – Currency risk does not arise from financial assets or liabilities denominated in the functional currencies of the Company and its subsidiary companies – Currency risk does not arise from financial instruments that are non-monetary items (iii) Credit exposure The Group’s credit risk is primarily attributable to trade and other receivables, derivative financial instruments, receivables from joint venture companies and associated companies and cash and deposits with banks and financial institutions. Risk management The exposure to these credit risks is closely monitored on a continuous basis by reference to established credit policies. For banks and financial institutions, only independently rated parties with investment grade credit ratings are accepted as counterparties. Tenants are assessed and rated based on their credit quality, taking into account their financial position, past experience and other factors. The Group does not grant credit terms to its customers, except to corporate customers in the hotel division where commercial trade credit terms are given. The Group also holds non-interest-bearing rental deposits as security against trade debtors. In addition, the Group and the Company monitor the exposure to credit risk in respect of the financial assistance provided to subsidiaries, joint venture and associated companies through exercising control, joint control or significant influence over their financial and operating policy decisions and reviewing their financial positions on a regular basis. The Group has the following major types of assets that are subject to the expected credit loss model: – Trade receivables – Other financial assets at amortised cost Trade receivables The Group applies the HKFRS 9 simplified approach to measuring expected credit losses which uses a lifetime expected loss allowance for trade receivables. As the Group’s historical credit loss experience does not indicate different loss patterns for different customer segments, the loss allowance based on past due status is not further distinguished among the Group’s different customer segments. The expected loss rates are based on historical payment profiles. These rates are adjusted to reflect current and forward-looking information about economic conditions. Trade receivables are written off when there is no reasonable expectation of recovery. Indicators include the failure of a debtor to engage in a repayment plan with the Group, and a failure to make contractual payments for a period of greater than 120 days past due. Impairment charges on trade receivables are presented as net impairment losses within operating profit. Subsequent recoveries of amounts previously written off are credited to the same line item. Other financial assets at amortised cost Other financial assets at amortised cost include other receivables and loans due from related parties. Loans due from joint venture, associated and other related companies are considered to have low credit risk as the financial positions and performances of these companies are regularly monitored and reviewed by management of the Group. SWIRE PROPERTIES ANNUAL REPORT 2022 SWIRE PROPERTIES ANNUAL REPORT 2022 143

Annual Report 2022 Page 144 Page 146

Annual Report 2022 Page 144 Page 146