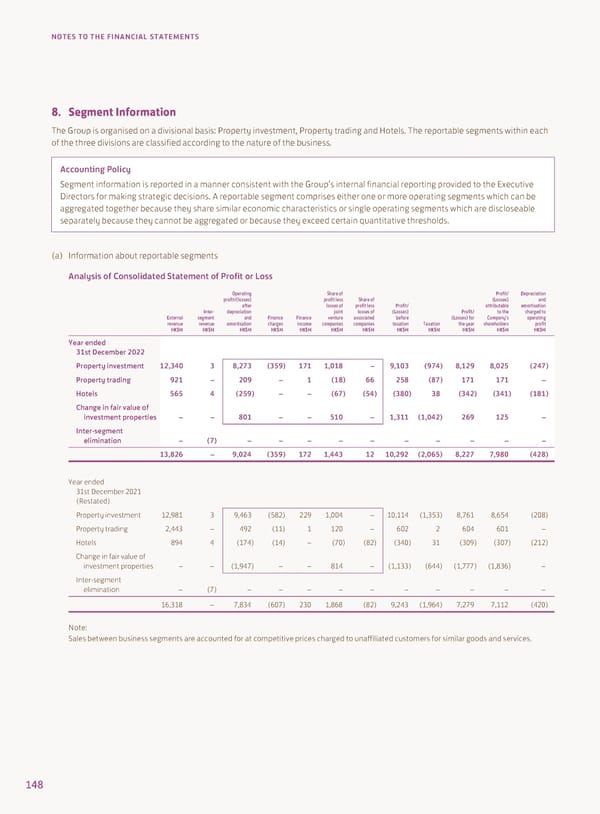

NOTES TO THE FINANCIAL STATEMENTS 8. Segment Information The Group is organised on a divisional basis: Property investment, Property trading and Hotels. The reportable segments within each of the three divisions are classified according to the nature of the business. Accounting Policy Segment information is reported in a manner consistent with the Group’s internal financial reporting provided to the Executive Directors for making strategic decisions. A reportable segment comprises either one or more operating segments which can be aggregated together because they share similar economic characteristics or single operating segments which are discloseable separately because they cannot be aggregated or because they exceed certain quantitative thresholds. (a) Information about reportable segments Analysis of Consolidated Statement of Profit or Loss Operating Share of Profit/ Depreciation profit/(losses) profit less Share of (Losses) and Inter- after losses of profit less Profit/ attributable amortisation External segment depreciation joint losses of (Losses) Profit/ to the charged to revenue revenue and Finance Finance venture associated before (Losses) for Company’s operating HK$M HK$M amortisation charges income companies companies taxation Taxation the year shareholders profit HK$M HK$M HK$M HK$M HK$M HK$M HK$M HK$M HK$M HK$M Year ended 31st December 2022 Property investment 12,340 3 8,273 (359) 171 1,018 – 9,103 (974) 8,129 8,025 (247) Property trading 921 – 209 – 1 (18) 66 258 (87) 171 171 – Hotels 565 4 (259) – – (67) (54) (380) 38 (342) (341) (181) Change in fair value of investment properties – – 801 – – 510 – 1,311 (1,042) 269 125 – Inter-segment elimination – (7) – – – – – – – – – – 13,826 – 9,024 (359) 172 1,443 12 10,292 (2,065) 8,227 7,980 (428) Year ended 31st December 2021 (Restated) Property investment 12,981 3 9,463 (582) 229 1,004 – 10,114 (1,353) 8,761 8,654 (208) Property trading 2,443 – 492 (11) 1 120 – 602 2 604 601 – Hotels 894 4 (174) (14) – (70) (82) (340) 31 (309) (307) (212) Change in fair value of investment properties – – (1,947) – – 814 – (1,133) (644) (1,777) (1,836) – Inter-segment elimination – (7) – – – – – – – – – – 16,318 – 7,834 (607) 230 1,868 (82) 9,243 (1,964) 7,279 7,112 (420) Note: Sales between business segments are accounted for at competitive prices charged to unaffiliated customers for similar goods and services. 148

Annual Report 2022 Page 149 Page 151

Annual Report 2022 Page 149 Page 151