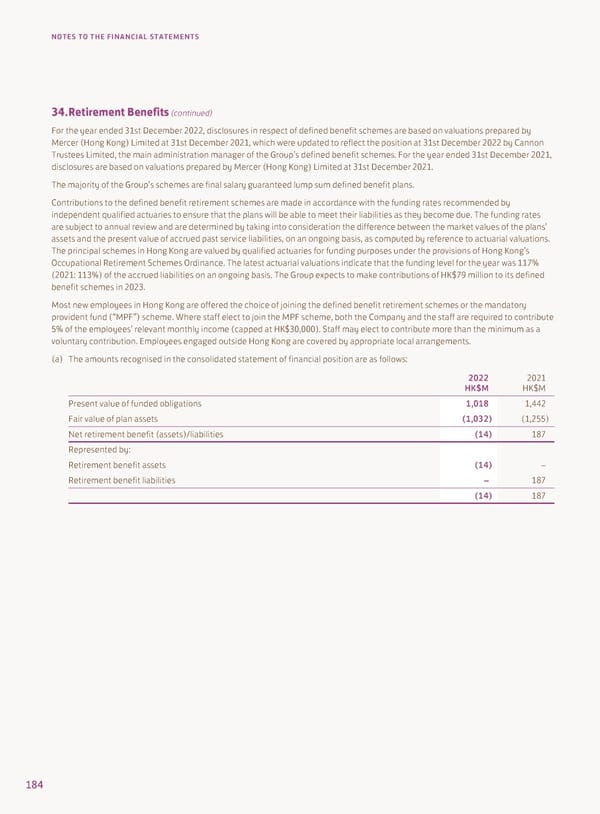

NOTES TO THE FINANCIAL STATEMENTS 34. Retirement Benefits (continued) For the year ended 31st December 2022, disclosures in respect of defined benefit schemes are based on valuations prepared by Mercer (Hong Kong) Limited at 31st December 2021, which were updated to reflect the position at 31st December 2022 by Cannon Trustees Limited, the main administration manager of the Group’s defined benefit schemes. For the year ended 31st December 2021, disclosures are based on valuations prepared by Mercer (Hong Kong) Limited at 31st December 2021. The majority of the Group’s schemes are final salary guaranteed lump sum defined benefit plans. Contributions to the defined benefit retirement schemes are made in accordance with the funding rates recommended by independent qualified actuaries to ensure that the plans will be able to meet their liabilities as they become due. The funding rates are subject to annual review and are determined by taking into consideration the difference between the market values of the plans’ assets and the present value of accrued past service liabilities, on an ongoing basis, as computed by reference to actuarial valuations. The principal schemes in Hong Kong are valued by qualified actuaries for funding purposes under the provisions of Hong Kong’s Occupational Retirement Schemes Ordinance. The latest actuarial valuations indicate that the funding level for the year was 117% (2021: 113%) of the accrued liabilities on an ongoing basis. The Group expects to make contributions of HK$79 million to its defined benefit schemes in 2023. Most new employees in Hong Kong are offered the choice of joining the defined benefit retirement schemes or the mandatory provident fund (“MPF”) scheme. Where staff elect to join the MPF scheme, both the Company and the staff are required to contribute 5% of the employees’ relevant monthly income (capped at HK$30,000). Staff may elect to contribute more than the minimum as a voluntary contribution. Employees engaged outside Hong Kong are covered by appropriate local arrangements. (a) The amounts recognised in the consolidated statement of financial position are as follows: 2022 2021 HK$M HK$M Present value of funded obligations 1,018 1,442 Fair value of plan assets (1,032) (1,255) Net retirement benefit (assets)/liabilities (14) 187 Represented by: Retirement benefit assets (14) – Retirement benefit liabilities – 187 (14) 187 184

Annual Report 2022 Page 185 Page 187

Annual Report 2022 Page 185 Page 187