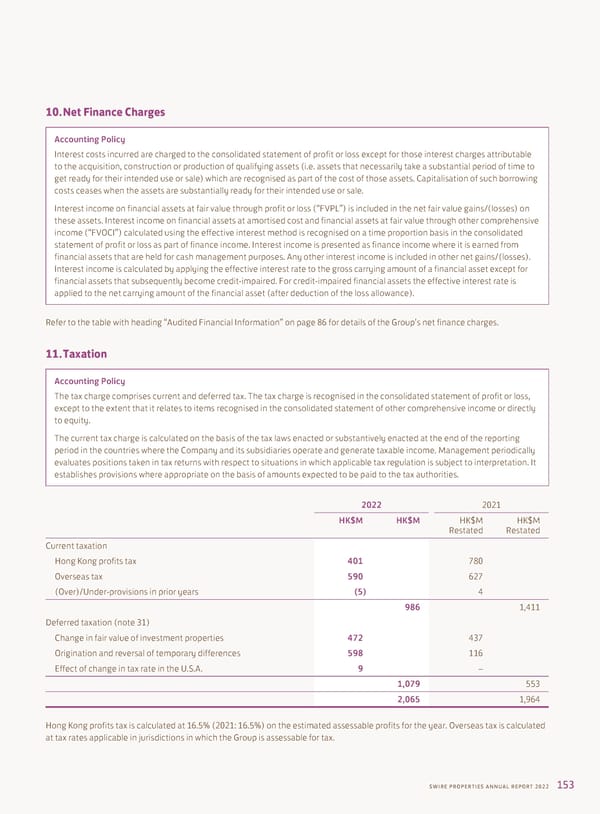

10. Net Finance Charges Accounting Policy Interest costs incurred are charged to the consolidated statement of profit or loss except for those interest charges attributable to the acquisition, construction or production of qualifying assets (i.e. assets that necessarily take a substantial period of time to get ready for their intended use or sale) which are recognised as part of the cost of those assets. Capitalisation of such borrowing costs ceases when the assets are substantially ready for their intended use or sale. Interest income on financial assets at fair value through profit or loss (“FVPL”) is included in the net fair value gains/(losses) on these assets. Interest income on financial assets at amortised cost and financial assets at fair value through other comprehensive income (“FVOCI”) calculated using the effective interest method is recognised on a time proportion basis in the consolidated statement of profit or loss as part of finance income. Interest income is presented as finance income where it is earned from financial assets that are held for cash management purposes. Any other interest income is included in other net gains/(losses). Interest income is calculated by applying the effective interest rate to the gross carrying amount of a financial asset except for financial assets that subsequently become credit-impaired. For credit-impaired financial assets the effective interest rate is applied to the net carrying amount of the financial asset (after deduction of the loss allowance). Refer to the table with heading “Audited Financial Information” on page 86 for details of the Group’s net finance charges. 11. Taxation Accounting Policy The tax charge comprises current and deferred tax. The tax charge is recognised in the consolidated statement of profit or loss, except to the extent that it relates to items recognised in the consolidated statement of other comprehensive income or directly to equity. The current tax charge is calculated on the basis of the tax laws enacted or substantively enacted at the end of the reporting period in the countries where the Company and its subsidiaries operate and generate taxable income. Management periodically evaluates positions taken in tax returns with respect to situations in which applicable tax regulation is subject to interpretation. It establishes provisions where appropriate on the basis of amounts expected to be paid to the tax authorities. 2022 2021 HK$M HK$M HK$M HK$M Restated Restated Current taxation Hong Kong profits tax 401 780 Overseas tax 590 627 (Over)/Under-provisions in prior years (5) 4 986 1,411 Deferred taxation (note 31) Change in fair value of investment properties 472 437 Origination and reversal of temporary differences 598 116 Effect of change in tax rate in the U.S.A. 9 – 1,079 553 2,065 1,964 Hong Kong profits tax is calculated at 16.5% (2021: 16.5%) on the estimated assessable profits for the year. Overseas tax is calculated at tax rates applicable in jurisdictions in which the Group is assessable for tax. SWIRE PROPERTIES ANNUAL REPORT 2022 153

Annual Report 2022 Page 154 Page 156

Annual Report 2022 Page 154 Page 156