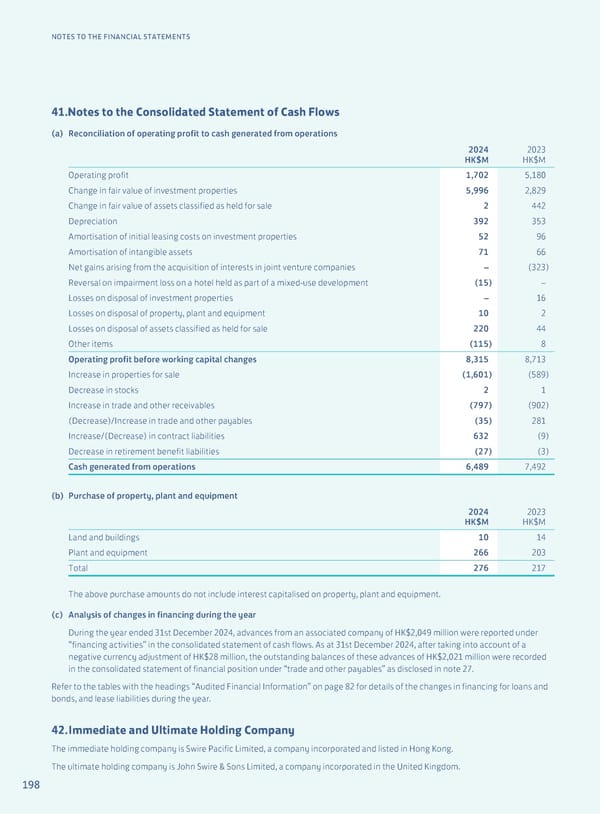

198 NOTES TO THE FINANCIAL STATEMENTS 41.Notes to the Consolidated Statement of Cash Flows (a) Reconciliation of operating profit to cash generated from operations 2024 HK$M 2023 HK$M Operating profit 1,702 5,180 Change in fair value of investment properties 5,996 2,829 Change in fair value of assets classified as held for sale 2 442 Depreciation 392 353 Amortisation of initial leasing costs on investment properties 52 96 Amortisation of intangible assets 71 66 Net gains arising from the acquisition of interests in joint venture companies – (323) Reversal on impairment loss on a hotel held as part of a mixed-use development (15) – Losses on disposal of investment properties – 16 Losses on disposal of property, plant and equipment 10 2 Losses on disposal of assets classified as held for sale 220 44 Other items (115) 8 Operating profit before working capital changes 8,315 8,713 Increase in properties for sale (1,601) (589) Decrease in stocks 2 1 Increase in trade and other receivables (797) (902) (Decrease)/Increase in trade and other payables (35) 281 Increase/(Decrease) in contract liabilities 632 (9) Decrease in retirement benefit liabilities (27) (3) Cash generated from operations 6,489 7,492 (b) Purchase of property, plant and equipment 2024 HK$M 2023 HK$M Land and buildings 10 14 Plant and equipment 266 203 Total 276 217 The above purchase amounts do not include interest capitalised on property, plant and equipment. (c) Analysis of changes in financing during the year During the year ended 31st December 2024, advances from an associated company of HK$2,049 million were reported under “financing activities” in the consolidated statement of cash flows. As at 31st December 2024, after taking into account of a negative currency adjustment of HK$28 million, the outstanding balances of these advances of HK$2,021 million were recorded in the consolidated statement of financial position under “trade and other payables” as disclosed in note 27. Refer to the tables with the headings “Audited Financial Information” on page 82 for details of the changes in financing for loans and bonds, and lease liabilities during the year. 42. Immediate and Ultimate Holding Company The immediate holding company is Swire Pacific Limited, a company incorporated and listed in Hong Kong. The ultimate holding company is John Swire & Sons Limited, a company incorporated in the United Kingdom.

Annual Report 2024 | EN Page 199 Page 201

Annual Report 2024 | EN Page 199 Page 201