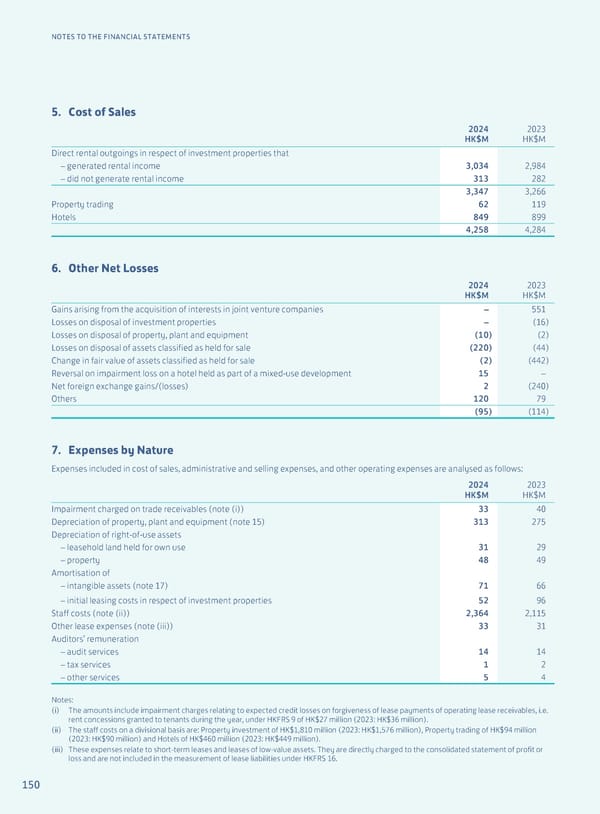

150 NOTES TO THE FINANCIAL STATEMENTS 5. Cost of Sales 2024 HK$M 2023 HK$M Direct rental outgoings in respect of investment properties that – generated rental income 3,034 2,984 – did not generate rental income 313 282 3,347 3,266 Property trading 62 119 Hotels 849 899 4,258 4,284 6. Other Net Losses 2024 HK$M 2023 HK$M Gains arising from the acquisition of interests in joint venture companies – 551 Losses on disposal of investment properties – (16) Losses on disposal of property, plant and equipment (10) (2) Losses on disposal of assets classified as held for sale (220) (44) Change in fair value of assets classified as held for sale (2) (442) Reversal on impairment loss on a hotel held as part of a mixed-use development 15 – Net foreign exchange gains/(losses) 2 (240) Others 120 79 (95) (114) 7. Expenses by Nature Expenses included in cost of sales, administrative and selling expenses, and other operating expenses are analysed as follows: 2024 HK$M 2023 HK$M Impairment charged on trade receivables (note (i)) 33 40 Depreciation of property, plant and equipment (note 15) 313 275 Depreciation of right-of-use assets – leasehold land held for own use 31 29 – property 48 49 Amortisation of – intangible assets (note 17) 71 66 – initial leasing costs in respect of investment properties 52 96 Staff costs (note (ii)) 2,364 2,115 Other lease expenses (note (iii)) 33 31 Auditors’ remuneration – audit services 14 14 – tax services 1 2 – other services 5 4 Notes: (i) The amounts include impairment charges relating to expected credit losses on forgiveness of lease payments of operating lease receivables, i.e. rent concessions granted to tenants during the year, under HKFRS 9 of HK$27 million (2023: HK$36 million). (ii) The staff costs on a divisional basis are: Property investment of HK$1,810 million (2023: HK$1,576 million), Property trading of HK$94 million (2023: HK$90 million) and Hotels of HK$460 million (2023: HK$449 million). (iii) These expenses relate to short-term leases and leases of low-value assets. They are directly charged to the consolidated statement of profit or loss and are not included in the measurement of lease liabilities under HKFRS 16.

Annual Report 2024 | EN Page 151 Page 153

Annual Report 2024 | EN Page 151 Page 153