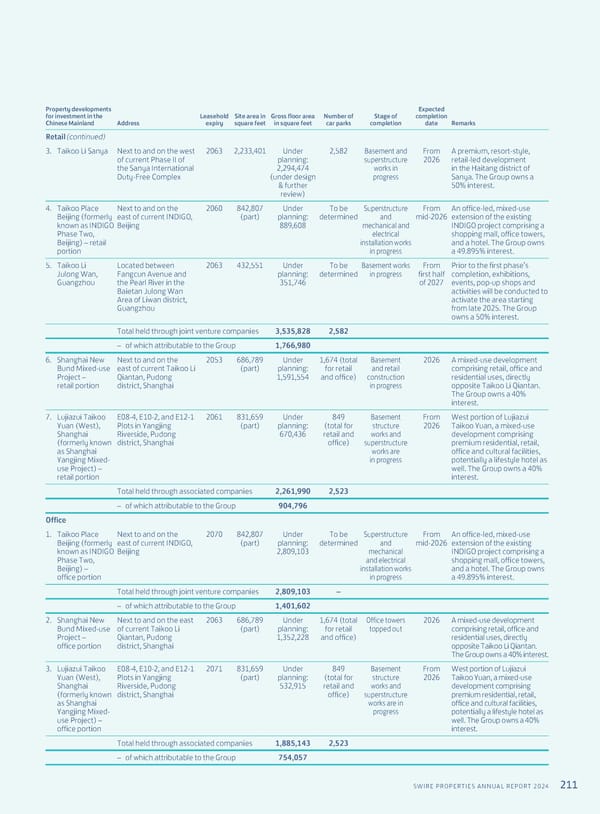

211 SWIRE PROPERTIES ANNUAL REPORT 2024 Property developments for investment in the Chinese Mainland Address Leasehold expiry Site area in square feet Gross floor area in square feet Number of car parks Stage of completion Expected completion date Remarks Retail (continued) 3. Taikoo Li Sanya Next to and on the west of current Phase II of the Sanya International Duty-Free Complex 2063 2,233,401 Under planning: 2,294,474 (under design & further review) 2,582 Basement and superstructure works in progress From 2026 A premium, resort-style, retail-led development in the Haitang district of Sanya. The Group owns a 50% interest. 4. Taikoo Place Beijing (formerly known as INDIGO Phase Two, Beijing) – retail portion Next to and on the east of current INDIGO, Beijing 2060 842,807 (part) Under planning: 889,608 To be determined Superstructure and mechanical and electrical installation works in progress From mid-2026 An office-led, mixed-use extension of the existing INDIGO project comprising a shopping mall, office towers, and a hotel. The Group owns a 49.895% interest. 5. Taikoo Li Julong Wan, Guangzhou Located between Fangcun Avenue and the Pearl River in the Baietan Julong Wan Area of Liwan district, Guangzhou 2063 432,551 Under planning: 351,746 To be determined Basement works in progress From first half of 2027 Prior to the first phase’s completion, exhibitions, events, pop-up shops and activities will be conducted to activate the area starting from late 2025. The Group owns a 50% interest. Total held through joint venture companies 3,535,828 2,582 – of which attributable to the Group 1,766,980 6. Shanghai New Bund Mixed-use Project – retail portion Next to and on the east of current Taikoo Li Qiantan, Pudong district, Shanghai 2053 686,789 (part) Under planning: 1,591,554 1,674 (total for retail and office) Basement and retail construction in progress 2026 A mixed-use development comprising retail, office and residential uses, directly opposite Taikoo Li Qiantan. The Group owns a 40% interest. 7. Lujiazui Taikoo Yuan (West), Shanghai (formerly known as Shanghai Yangjing Mixed- use Project) – retail portion E08-4, E10-2, and E12-1 Plots in Yangjing Riverside, Pudong district, Shanghai 2061 831,659 (part) Under planning: 670,436 849 (total for retail and office) Basement structure works and superstructure works are in progress From 2026 West portion of Lujiazui Taikoo Yuan, a mixed-use development comprising premium residential, retail, office and cultural facilities, potentially a lifestyle hotel as well. The Group owns a 40% interest. Total held through associated companies 2,261,990 2,523 – of which attributable to the Group 904,796 Office 1. Taikoo Place Beijing (formerly known as INDIGO Phase Two, Beijing) – office portion Next to and on the east of current INDIGO, Beijing 2070 842,807 (part) Under planning: 2,809,103 To be determined Superstructure and mechanical and electrical installation works in progress From mid-2026 An office-led, mixed-use extension of the existing INDIGO project comprising a shopping mall, office towers, and a hotel. The Group owns a 49.895% interest. Total held through joint venture companies 2,809,103 – – of which attributable to the Group 1,401,602 2. Shanghai New Bund Mixed-use Project – office portion Next to and on the east of current Taikoo Li Qiantan, Pudong district, Shanghai 2063 686,789 (part) Under planning: 1,352,228 1,674 (total for retail and office) Office towers topped out 2026 A mixed-use development comprising retail, office and residential uses, directly opposite Taikoo Li Qiantan. The Group owns a 40% interest. 3. Lujiazui Taikoo Yuan (West), Shanghai (formerly known as Shanghai Yangjing Mixed- use Project) – office portion E08-4, E10-2, and E12-1 Plots in Yangjing Riverside, Pudong district, Shanghai 2071 831,659 (part) Under planning: 532,915 849 (total for retail and office) Basement structure works and superstructure works are in progress From 2026 West portion of Lujiazui Taikoo Yuan, a mixed-use development comprising premium residential, retail, office and cultural facilities, potentially a lifestyle hotel as well. The Group owns a 40% interest. Total held through associated companies 1,885,143 2,523 – of which attributable to the Group 754,057

Annual Report 2024 | EN Page 212 Page 214

Annual Report 2024 | EN Page 212 Page 214