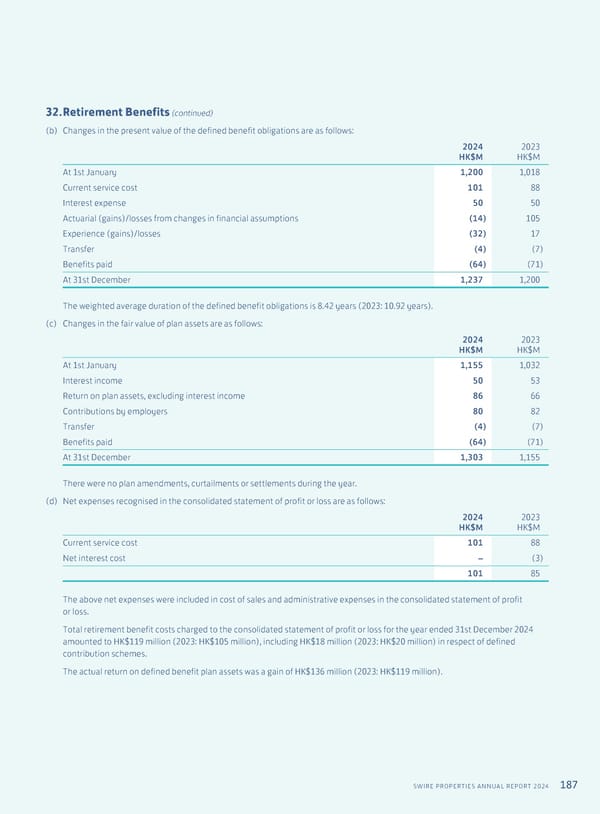

187 SWIRE PROPERTIES ANNUAL REPORT 2024 32. Retirement Benefits (continued) (b) Changes in the present value of the defined benefit obligations are as follows: 2024 HK$M 2023 HK$M At 1st January 1,200 1,018 Current service cost 101 88 Interest expense 50 50 Actuarial (gains)/losses from changes in financial assumptions (14) 105 Experience (gains)/losses (32) 17 Transfer (4) (7) Benefits paid (64) (71) At 31st December 1,237 1,200 The weighted average duration of the defined benefit obligations is 8.42 years (2023: 10.92 years). (c) Changes in the fair value of plan assets are as follows: 2024 HK$M 2023 HK$M At 1st January 1,155 1,032 Interest income 50 53 Return on plan assets, excluding interest income 86 66 Contributions by employers 80 82 Transfer (4) (7) Benefits paid (64) (71) At 31st December 1,303 1,155 There were no plan amendments, curtailments or settlements during the year. (d) Net expenses recognised in the consolidated statement of profit or loss are as follows: 2024 HK$M 2023 HK$M Current service cost 101 88 Net interest cost – (3) 101 85 The above net expenses were included in cost of sales and administrative expenses in the consolidated statement of profit or loss. Total retirement benefit costs charged to the consolidated statement of profit or loss for the year ended 31st December 2024 amounted to HK$119 million (2023: HK$105 million), including HK$18 million (2023: HK$20 million) in respect of defined contribution schemes. The actual return on defined benefit plan assets was a gain of HK$136 million (2023: HK$119 million).

Annual Report 2024 | EN Page 188 Page 190

Annual Report 2024 | EN Page 188 Page 190