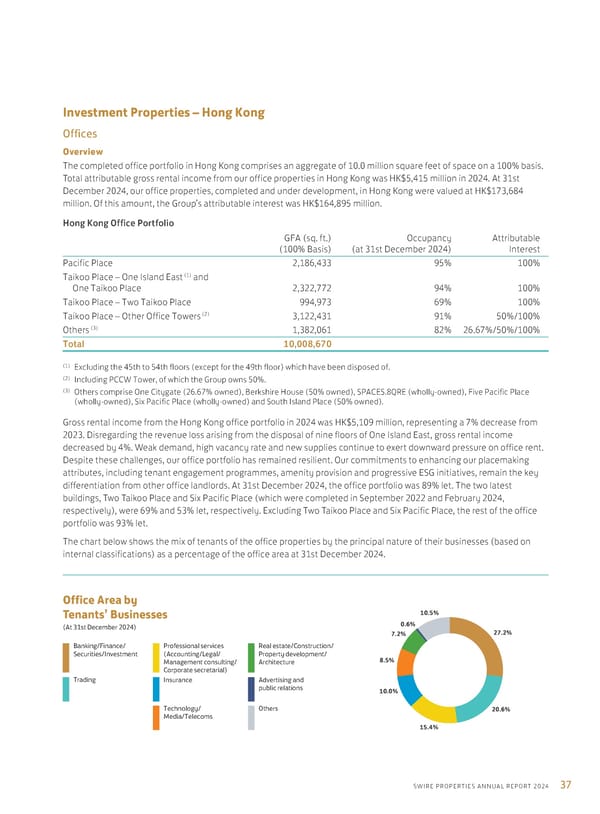

27.2% 15.4% 8.5% 7.2% 20.6% 10.0% 0.6% 10.5% Banking/Finance/ Securities/Investment Trading Professional services (Accounting/Legal/ Management consulting/ Corporate secretarial) Insurance Technology/ Media/Telecoms Real estate/Construction/ Property development/ Architecture Advertising and public relations Others Office Area by Tenants’ Businesses (At 31st December 2024) 37 SWIRE PROPERTIES ANNUAL REPORT 2024 Investment Properties – Hong Kong Offices Overview The completed office portfolio in Hong Kong comprises an aggregate of 10.0 million square feet of space on a 100% basis. Total attributable gross rental income from our office properties in Hong Kong was HK$5,415 million in 2024. At 31st December 2024, our office properties, completed and under development, in Hong Kong were valued at HK$173,684 million. Of this amount, the Group’s attributable interest was HK$164,895 million. Hong Kong Office Portfolio GFA (sq. ft.) (100% Basis) Occupancy (at 31st December 2024) Attributable Interest Pacific Place 2,186,433 95% 100% Taikoo Place – One Island East (1) and One Taikoo Place 2,322,772 94% 100% Taikoo Place – Two Taikoo Place 994,973 69% 100% Taikoo Place – Other Office Towers (2) 3,122,431 91% 50%/100% Others (3) 1,382,061 82% 26.67%/50%/100% Total 10,008,670 (1) Excluding the 45th to 54th floors (except for the 49th floor) which have been disposed of. (2) Including PCCW Tower, of which the Group owns 50%. (3) Others comprise One Citygate (26.67% owned), Berkshire House (50% owned), SPACES.8QRE (wholly-owned), Five Pacific Place (wholly-owned), Six Pacific Place (wholly-owned) and South Island Place (50% owned). Gross rental income from the Hong Kong office portfolio in 2024 was HK$5,109 million, representing a 7% decrease from 2023. Disregarding the revenue loss arising from the disposal of nine floors of One Island East, gross rental income decreased by 4%. Weak demand, high vacancy rate and new supplies continue to exert downward pressure on office rent. Despite these challenges, our office portfolio has remained resilient. Our commitments to enhancing our placemaking attributes, including tenant engagement programmes, amenity provision and progressive ESG initiatives, remain the key differentiation from other office landlords. At 31st December 2024, the office portfolio was 89% let. The two latest buildings, Two Taikoo Place and Six Pacific Place (which were completed in September 2022 and February 2024, respectively), were 69% and 53% let, respectively. Excluding Two Taikoo Place and Six Pacific Place, the rest of the office portfolio was 93% let. The chart below shows the mix of tenants of the office properties by the principal nature of their businesses (based on internal classifications) as a percentage of the office area at 31st December 2024.

Annual Report 2024 | EN Page 38 Page 40

Annual Report 2024 | EN Page 38 Page 40