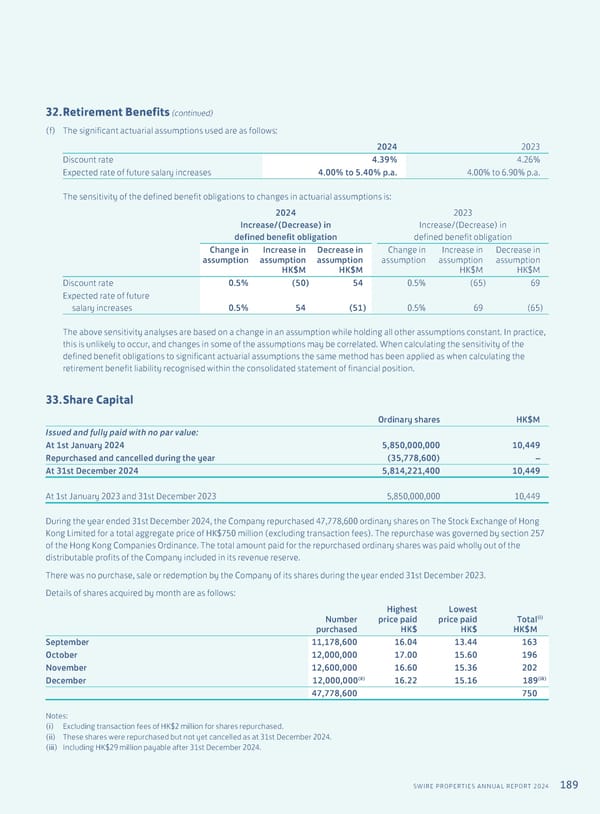

189 SWIRE PROPERTIES ANNUAL REPORT 2024 32. Retirement Benefits (continued) (f) The significant actuarial assumptions used are as follows: 2024 2023 Discount rate 4.39% 4.26% Expected rate of future salary increases 4.00% to 5.40% p.a. 4.00% to 6.90% p.a. The sensitivity of the defined benefit obligations to changes in actuarial assumptions is: 2024 Increase/(Decrease) in defined benefit obligation 2023 Increase/(Decrease) in defined benefit obligation Change in assumption Increase in assumption HK$M Decrease in assumption HK$M Change in assumption Increase in assumption HK$M Decrease in assumption HK$M Discount rate 0.5% (50) 54 0.5% (65) 69 Expected rate of future salary increases 0.5% 54 (51) 0.5% 69 (65) The above sensitivity analyses are based on a change in an assumption while holding all other assumptions constant. In practice, this is unlikely to occur, and changes in some of the assumptions may be correlated. When calculating the sensitivity of the defined benefit obligations to significant actuarial assumptions the same method has been applied as when calculating the retirement benefit liability recognised within the consolidated statement of financial position. 33. Share Capital Ordinary shares HK$M Issued and fully paid with no par value: At 1st January 2024 5,850,000,000 10,449 Repurchased and cancelled during the year (35,778,600) – At 31st December 2024 5,814,221,400 10,449 At 1st January 2023 and 31st December 2023 5,850,000,000 10,449 During the year ended 31st December 2024, the Company repurchased 47,778,600 ordinary shares on The Stock Exchange of Hong Kong Limited for a total aggregate price of HK$750 million (excluding transaction fees). The repurchase was governed by section 257 of the Hong Kong Companies Ordinance. The total amount paid for the repurchased ordinary shares was paid wholly out of the distributable profits of the Company included in its revenue reserve. There was no purchase, sale or redemption by the Company of its shares during the year ended 31st December 2023. Details of shares acquired by month are as follows: Number purchased Highest price paid HK$ Lowest price paid HK$ Total(i) HK$M September 11,178,600 16.04 13.44 163 October 12,000,000 17.00 15.60 196 November 12,600,000 16.60 15.36 202 December 12,000,000(ii) 16.22 15.16 189(iii) 47,778,600 750 Notes: (i) Excluding transaction fees of HK$2 million for shares repurchased. (ii) These shares were repurchased but not yet cancelled as at 31st December 2024. (iii) Including HK$29 million payable after 31st December 2024.

Annual Report 2024 | EN Page 190 Page 192

Annual Report 2024 | EN Page 190 Page 192