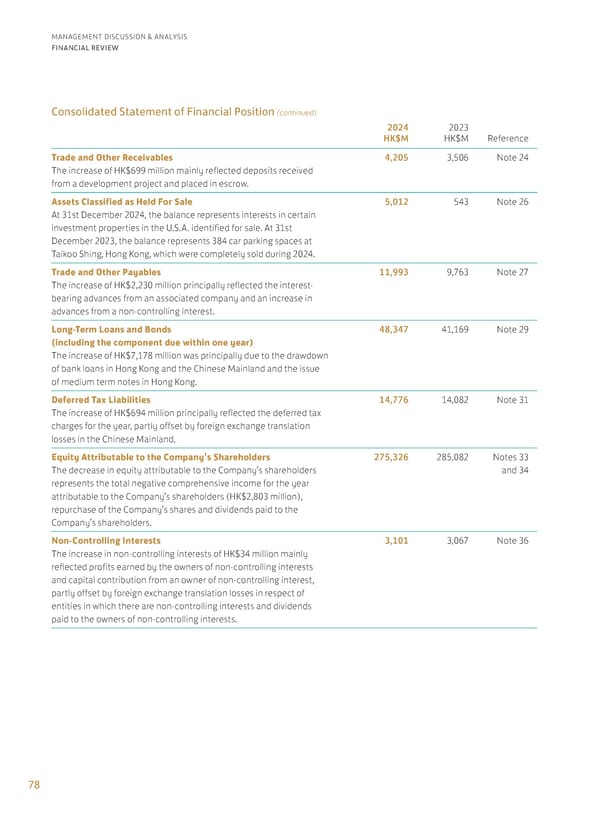

78 MANAGEMENT DISCUSSION & ANALYSIS FINANCIAL REVIEW Consolidated Statement of Financial Position (continued) 2024 HK$M 2023 HK$M Reference Trade and Other Receivables The increase of HK$699 million mainly reflected deposits received from a development project and placed in escrow. 4,205 3,506 Note 24 Assets Classified as Held For Sale At 31st December 2024, the balance represents interests in certain investment properties in the U.S.A. identified for sale. At 31st December 2023, the balance represents 384 car parking spaces at Taikoo Shing, Hong Kong, which were completely sold during 2024. 5,012 543 Note 26 Trade and Other Payables The increase of HK$2,230 million principally reflected the interest- bearing advances from an associated company and an increase in advances from a non-controlling interest. 11,993 9,763 Note 27 Long-Term Loans and Bonds (including the component due within one year) The increase of HK$7,178 million was principally due to the drawdown of bank loans in Hong Kong and the Chinese Mainland and the issue of medium term notes in Hong Kong. 48,347 41,169 Note 29 Deferred Tax Liabilities The increase of HK$694 million principally reflected the deferred tax charges for the year, partly offset by foreign exchange translation losses in the Chinese Mainland. 14,776 14,082 Note 31 Equity Attributable to the Company’s Shareholders The decrease in equity attributable to the Company’s shareholders represents the total negative comprehensive income for the year attributable to the Company’s shareholders (HK$2,803 million), repurchase of the Company’s shares and dividends paid to the Company’s shareholders. 275,326 285,082 Notes 33 and 34 Non-Controlling Interests The increase in non-controlling interests of HK$34 million mainly reflected profits earned by the owners of non-controlling interests and capital contribution from an owner of non-controlling interest, partly offset by foreign exchange translation losses in respect of entities in which there are non-controlling interests and dividends paid to the owners of non-controlling interests. 3,101 3,067 Note 36

Annual Report 2024 | EN Page 79 Page 81

Annual Report 2024 | EN Page 79 Page 81