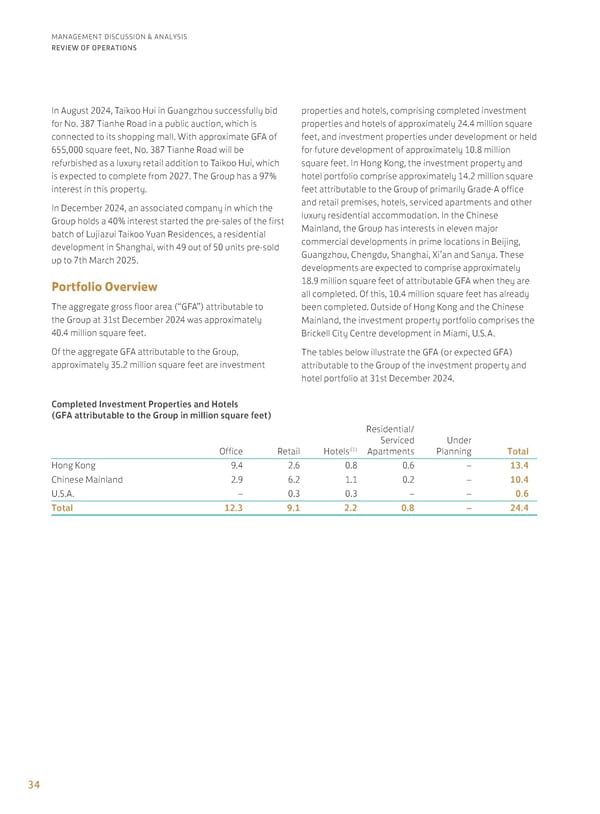

34 MANAGEMENT DISCUSSION & ANALYSIS REVIEW OF OPERATIONS Completed Investment Properties and Hotels (GFA attributable to the Group in million square feet) Office Retail Hotels(1) Residential/ Serviced Apartments Under Planning Total Hong Kong 9.4 2.6 0.8 0.6 – 13.4 Chinese Mainland 2.9 6.2 1.1 0.2 – 10.4 U.S.A. – 0.3 0.3 – – 0.6 Total 12.3 9.1 2.2 0.8 – 24.4 In August 2024, Taikoo Hui in Guangzhou successfully bid for No. 387 Tianhe Road in a public auction, which is connected to its shopping mall. With approximate GFA of 655,000 square feet, No. 387 Tianhe Road will be refurbished as a luxury retail addition to Taikoo Hui, which is expected to complete from 2027. The Group has a 97% interest in this property. In December 2024, an associated company in which the Group holds a 40% interest started the pre-sales of the first batch of Lujiazui Taikoo Yuan Residences, a residential development in Shanghai, with 49 out of 50 units pre-sold up to 7th March 2025. Portfolio Overview The aggregate gross floor area (“GFA”) attributable to the Group at 31st December 2024 was approximately 40.4 million square feet. Of the aggregate GFA attributable to the Group, approximately 35.2 million square feet are investment properties and hotels, comprising completed investment properties and hotels of approximately 24.4 million square feet, and investment properties under development or held for future development of approximately 10.8 million square feet. In Hong Kong, the investment property and hotel portfolio comprise approximately 14.2 million square feet attributable to the Group of primarily Grade-A office and retail premises, hotels, serviced apartments and other luxury residential accommodation. In the Chinese Mainland, the Group has interests in eleven major commercial developments in prime locations in Beijing, Guangzhou, Chengdu, Shanghai, Xi’an and Sanya. These developments are expected to comprise approximately 18.9 million square feet of attributable GFA when they are all completed. Of this, 10.4 million square feet has already been completed. Outside of Hong Kong and the Chinese Mainland, the investment property portfolio comprises the Brickell City Centre development in Miami, U.S.A. The tables below illustrate the GFA (or expected GFA) attributable to the Group of the investment property and hotel portfolio at 31st December 2024.

Annual Report 2024 | EN Page 35 Page 37

Annual Report 2024 | EN Page 35 Page 37