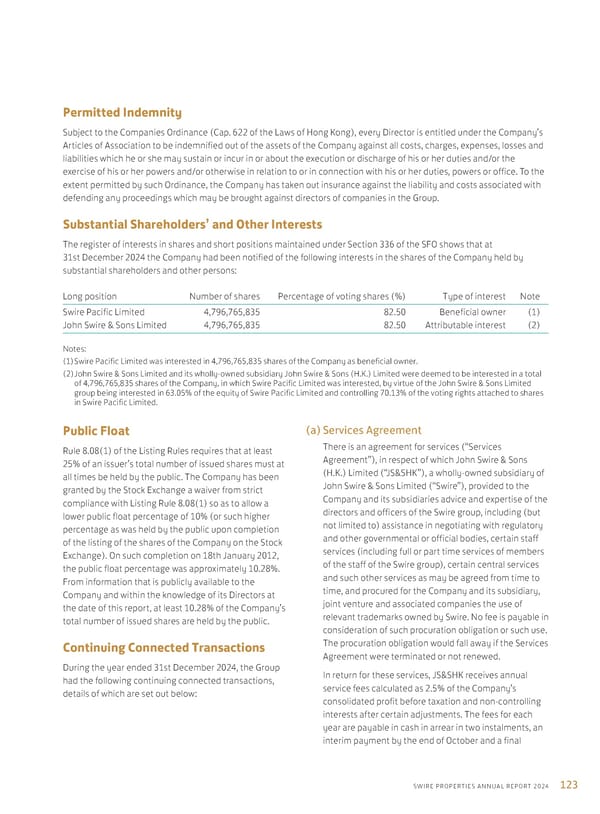

123 SWIRE PROPERTIES ANNUAL REPORT 2024 Long position Number of shares Percentage of voting shares (%) Type of interest Note Swire Pacific Limited 4,796,765,835 82.50 Beneficial owner (1) John Swire & Sons Limited 4,796,765,835 82.50 Attributable interest (2) Notes: (1) Swire Pacific Limited was interested in 4,796,765,835 shares of the Company as beneficial owner. (2) John Swire & Sons Limited and its wholly-owned subsidiary John Swire & Sons (H.K.) Limited were deemed to be interested in a total of 4,796,765,835 shares of the Company, in which Swire Pacific Limited was interested, by virtue of the John Swire & Sons Limited group being interested in 63.05% of the equity of Swire Pacific Limited and controlling 70.13% of the voting rights attached to shares in Swire Pacific Limited. Permitted Indemnity Subject to the Companies Ordinance (Cap. 622 of the Laws of Hong Kong), every Director is entitled under the Company’s Articles of Association to be indemnified out of the assets of the Company against all costs, charges, expenses, losses and liabilities which he or she may sustain or incur in or about the execution or discharge of his or her duties and/or the exercise of his or her powers and/or otherwise in relation to or in connection with his or her duties, powers or office. To the extent permitted by such Ordinance, the Company has taken out insurance against the liability and costs associated with defending any proceedings which may be brought against directors of companies in the Group. Substantial Shareholders’ and Other Interests The register of interests in shares and short positions maintained under Section 336 of the SFO shows that at 31st December 2024 the Company had been notified of the following interests in the shares of the Company held by substantial shareholders and other persons: Public Float Rule 8.08(1) of the Listing Rules requires that at least 25% of an issuer’s total number of issued shares must at all times be held by the public. The Company has been granted by the Stock Exchange a waiver from strict compliance with Listing Rule 8.08(1) so as to allow a lower public float percentage of 10% (or such higher percentage as was held by the public upon completion of the listing of the shares of the Company on the Stock Exchange). On such completion on 18th January 2012, the public float percentage was approximately 10.28%. From information that is publicly available to the Company and within the knowledge of its Directors at the date of this report, at least 10.28% of the Company’s total number of issued shares are held by the public. Continuing Connected Transactions During the year ended 31st December 2024, the Group had the following continuing connected transactions, details of which are set out below: (a) Services Agreement There is an agreement for services (“Services Agreement”), in respect of which John Swire & Sons (H.K.) Limited (“JS&SHK”), a wholly-owned subsidiary of John Swire & Sons Limited (“Swire”), provided to the Company and its subsidiaries advice and expertise of the directors and officers of the Swire group, including (but not limited to) assistance in negotiating with regulatory and other governmental or official bodies, certain staff services (including full or part time services of members of the staff of the Swire group), certain central services and such other services as may be agreed from time to time, and procured for the Company and its subsidiary, joint venture and associated companies the use of relevant trademarks owned by Swire. No fee is payable in consideration of such procuration obligation or such use. The procuration obligation would fall away if the Services Agreement were terminated or not renewed. In return for these services, JS&SHK receives annual service fees calculated as 2.5% of the Company’s consolidated profit before taxation and non-controlling interests after certain adjustments. The fees for each year are payable in cash in arrear in two instalments, an interim payment by the end of October and a final

Annual Report 2024 | EN Page 124 Page 126

Annual Report 2024 | EN Page 124 Page 126