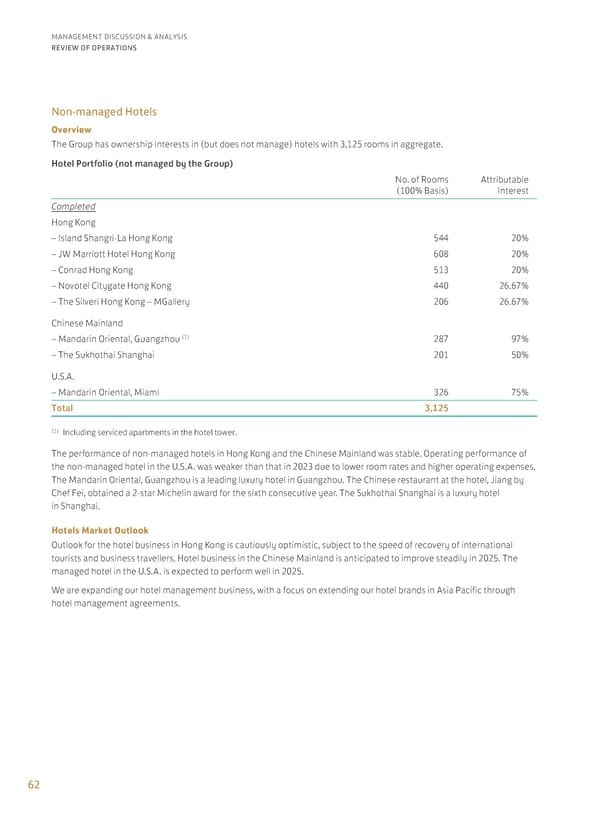

62 MANAGEMENT DISCUSSION & ANALYSIS REVIEW OF OPERATIONS Non-managed Hotels Overview The Group has ownership interests in (but does not manage) hotels with 3,125 rooms in aggregate. Hotel Portfolio (not managed by the Group) No. of Rooms (100% Basis) Attributable Interest Completed Hong Kong – Island Shangri-La Hong Kong 544 20% – JW Marriott Hotel Hong Kong 608 20% – Conrad Hong Kong 513 20% – Novotel Citygate Hong Kong 440 26.67% – The Silveri Hong Kong – MGallery 206 26.67% Chinese Mainland – Mandarin Oriental, Guangzhou (1) 287 97% – The Sukhothai Shanghai 201 50% U.S.A. – Mandarin Oriental, Miami 326 75% Total 3,125 (1) Including serviced apartments in the hotel tower. The performance of non-managed hotels in Hong Kong and the Chinese Mainland was stable. Operating performance of the non-managed hotel in the U.S.A. was weaker than that in 2023 due to lower room rates and higher operating expenses. The Mandarin Oriental, Guangzhou is a leading luxury hotel in Guangzhou. The Chinese restaurant at the hotel, Jiang by Chef Fei, obtained a 2-star Michelin award for the sixth consecutive year. The Sukhothai Shanghai is a luxury hotel in Shanghai. Hotels Market Outlook Outlook for the hotel business in Hong Kong is cautiously optimistic, subject to the speed of recovery of international tourists and business travellers. Hotel business in the Chinese Mainland is anticipated to improve steadily in 2025. The managed hotel in the U.S.A. is expected to perform well in 2025. We are expanding our hotel management business, with a focus on extending our hotel brands in Asia Pacific through hotel management agreements.

Annual Report 2024 | EN Page 63 Page 65

Annual Report 2024 | EN Page 63 Page 65