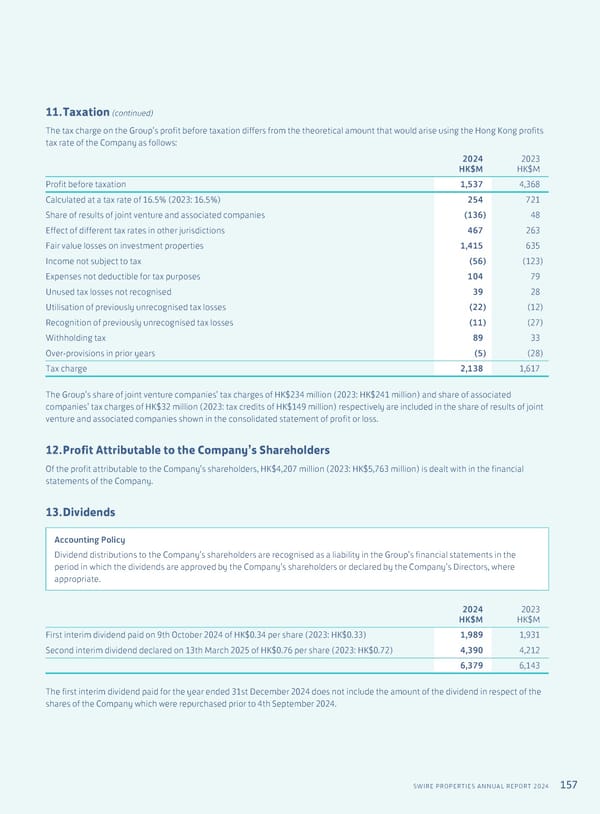

157 SWIRE PROPERTIES ANNUAL REPORT 2024 11. Taxation (continued) The tax charge on the Group’s profit before taxation differs from the theoretical amount that would arise using the Hong Kong profits tax rate of the Company as follows: 2024 HK$M 2023 HK$M Profit before taxation 1,537 4,368 Calculated at a tax rate of 16.5% (2023: 16.5%) 254 721 Share of results of joint venture and associated companies (136) 48 Effect of different tax rates in other jurisdictions 467 263 Fair value losses on investment properties 1,415 635 Income not subject to tax (56) (123) Expenses not deductible for tax purposes 104 79 Unused tax losses not recognised 39 28 Utilisation of previously unrecognised tax losses (22) (12) Recognition of previously unrecognised tax losses (11) (27) Withholding tax 89 33 Over-provisions in prior years (5) (28) Tax charge 2,138 1,617 The Group’s share of joint venture companies’ tax charges of HK$234 million (2023: HK$241 million) and share of associated companies’ tax charges of HK$32 million (2023: tax credits of HK$149 million) respectively are included in the share of results of joint venture and associated companies shown in the consolidated statement of profit or loss. 12. Profit Attributable to the Company’s Shareholders Of the profit attributable to the Company’s shareholders, HK$4,207 million (2023: HK$5,763 million) is dealt with in the financial statements of the Company. 13. Dividends Accounting Policy Dividend distributions to the Company’s shareholders are recognised as a liability in the Group’s financial statements in the period in which the dividends are approved by the Company’s shareholders or declared by the Company’s Directors, where appropriate. 2024 HK$M 2023 HK$M First interim dividend paid on 9th October 2024 of HK$0.34 per share (2023: HK$0.33) 1,989 1,931 Second interim dividend declared on 13th March 2025 of HK$0.76 per share (2023: HK$0.72) 4,390 4,212 6,379 6,143 The first interim dividend paid for the year ended 31st December 2024 does not include the amount of the dividend in respect of the shares of the Company which were repurchased prior to 4th September 2024.

Annual Report 2024 | EN Page 158 Page 160

Annual Report 2024 | EN Page 158 Page 160