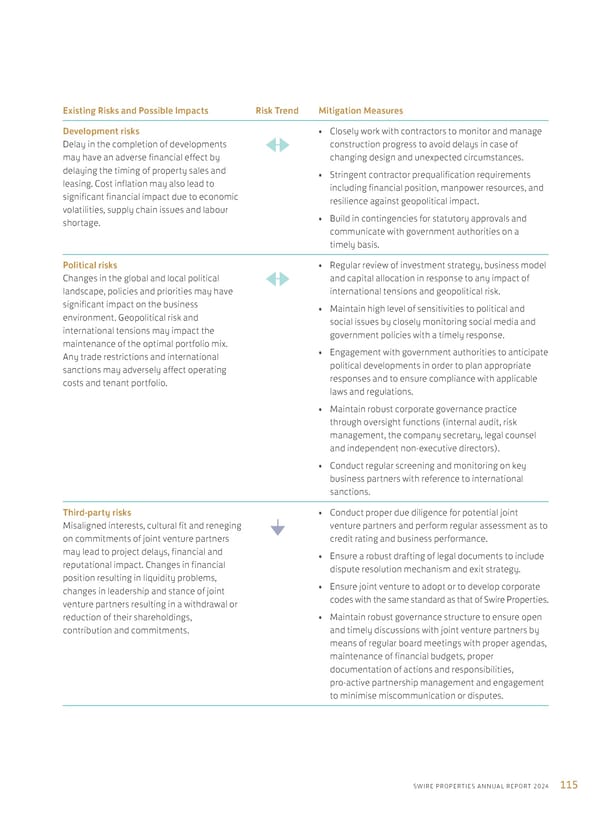

115 SWIRE PROPERTIES ANNUAL REPORT 2024 Existing Risks and Possible Impacts Risk Trend Mitigation Measures Development risks Delay in the completion of developments may have an adverse financial effect by delaying the timing of property sales and leasing. Cost inflation may also lead to significant financial impact due to economic volatilities, supply chain issues and labour shortage. • Closely work with contractors to monitor and manage construction progress to avoid delays in case of changing design and unexpected circumstances. • Stringent contractor prequalification requirements including financial position, manpower resources, and resilience against geopolitical impact. • Build in contingencies for statutory approvals and communicate with government authorities on a timely basis. Political risks Changes in the global and local political landscape, policies and priorities may have significant impact on the business environment. Geopolitical risk and international tensions may impact the maintenance of the optimal portfolio mix. Any trade restrictions and international sanctions may adversely affect operating costs and tenant portfolio. • Regular review of investment strategy, business model and capital allocation in response to any impact of international tensions and geopolitical risk. • Maintain high level of sensitivities to political and social issues by closely monitoring social media and government policies with a timely response. • Engagement with government authorities to anticipate political developments in order to plan appropriate responses and to ensure compliance with applicable laws and regulations. • Maintain robust corporate governance practice through oversight functions (internal audit, risk management, the company secretary, legal counsel and independent non-executive directors). • Conduct regular screening and monitoring on key business partners with reference to international sanctions. Third-party risks Misaligned interests, cultural fit and reneging on commitments of joint venture partners may lead to project delays, financial and reputational impact. Changes in financial position resulting in liquidity problems, changes in leadership and stance of joint venture partners resulting in a withdrawal or reduction of their shareholdings, contribution and commitments. • Conduct proper due diligence for potential joint venture partners and perform regular assessment as to credit rating and business performance. • Ensure a robust drafting of legal documents to include dispute resolution mechanism and exit strategy. • Ensure joint venture to adopt or to develop corporate codes with the same standard as that of Swire Properties. • Maintain robust governance structure to ensure open and timely discussions with joint venture partners by means of regular board meetings with proper agendas, maintenance of financial budgets, proper documentation of actions and responsibilities, pro-active partnership management and engagement to minimise miscommunication or disputes.

Annual Report 2024 | EN Page 116 Page 118

Annual Report 2024 | EN Page 116 Page 118