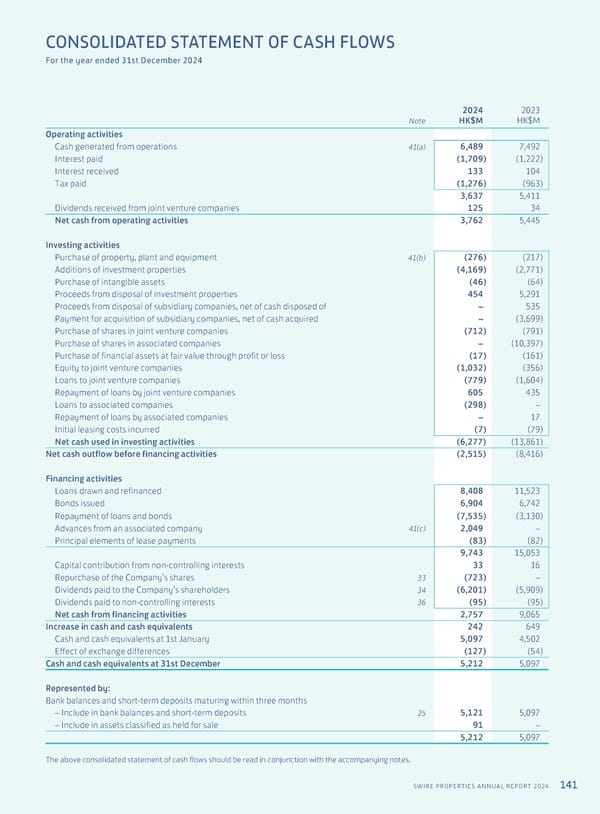

141 SWIRE PROPERTIES ANNUAL REPORT 2024 Note 2024 HK$M 2023 HK$M Operating activities Cash generated from operations 41(a) 6,489 7,492 Interest paid (1,709) (1,222) Interest received 133 104 Tax paid (1,276) (963) 3,637 5,411 Dividends received from joint venture companies 125 34 Net cash from operating activities 3,762 5,445 Investing activities Purchase of property, plant and equipment 41(b) (276) (217) Additions of investment properties (4,169) (2,771) Purchase of intangible assets (46) (64) Proceeds from disposal of investment properties 454 5,291 Proceeds from disposal of subsidiary companies, net of cash disposed of – 535 Payment for acquisition of subsidiary companies, net of cash acquired – (3,699) Purchase of shares in joint venture companies (712) (791) Purchase of shares in associated companies – (10,397) Purchase of financial assets at fair value through profit or loss (17) (161) Equity to joint venture companies (1,032) (356) Loans to joint venture companies (779) (1,604) Repayment of loans by joint venture companies 605 435 Loans to associated companies (298) – Repayment of loans by associated companies – 17 Initial leasing costs incurred (7) (79) Net cash used in investing activities (6,277) (13,861) Net cash outflow before financing activities (2,515) (8,416) Financing activities Loans drawn and refinanced 8,408 11,523 Bonds issued 6,904 6,742 Repayment of loans and bonds (7,535) (3,130) Advances from an associated company 41(c) 2,049 – Principal elements of lease payments (83) (82) 9,743 15,053 Capital contribution from non-controlling interests 33 16 Repurchase of the Company’s shares 33 (723) – Dividends paid to the Company’s shareholders 34 (6,201) (5,909) Dividends paid to non-controlling interests 36 (95) (95) Net cash from financing activities 2,757 9,065 Increase in cash and cash equivalents 242 649 Cash and cash equivalents at 1st January 5,097 4,502 Effect of exchange differences (127) (54) Cash and cash equivalents at 31st December 5,212 5,097 Represented by: Bank balances and short-term deposits maturing within three months – Include in bank balances and short-term deposits 25 5,121 5,097 – Include in assets classified as held for sale 91 – 5,212 5,097 The above consolidated statement of cash flows should be read in conjunction with the accompanying notes. CONSOLIDATED STATEMENT OF CASH FLOWS For the year ended 31st December 2024

Annual Report 2024 | EN Page 142 Page 144

Annual Report 2024 | EN Page 142 Page 144