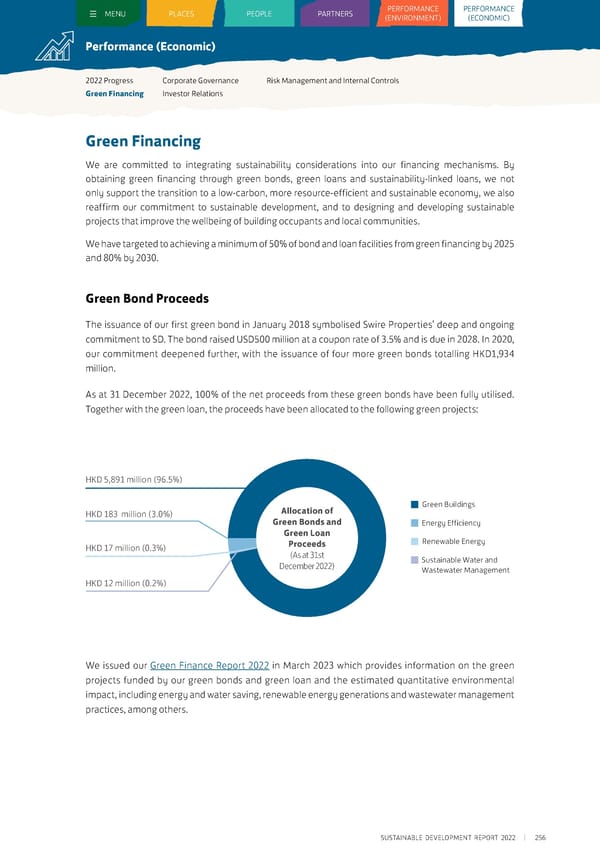

MENU PLACES PEOPLE PARTNERS PERFORMANCE PEPERFORFORRMMAANNCCEE (ENVIRONMENT) ((EECCONOONOMMIICC)) Performance (Economic) 2022 Progress Corporate Governance Risk Management and Internal Controls Green Financing Investor Relations Green Financing We are committed to integrating sustainability considerations into our financing mechanisms. By obtaining green financing through green bonds, green loans and sustainability-linked loans, we not only support the transition to a low-carbon, more resource-efficient and sustainable economy, we also reaffirm our commitment to sustainable development, and to designing and developing sustainable projects that improve the wellbeing of building occupants and local communities. We have targeted to achieving a minimum of 50% of bond and loan facilities from green financing by 2025 and 80% by 2030. Green Bond Proceeds The issuance of our first green bond in January 2018 symbolised Swire Properties’ deep and ongoing commitment to SD. The bond raised USD500 million at a coupon rate of 3.5% and is due in 2028. In 2020, our commitment deepened further, with the issuance of four more green bonds totalling HKD1,934 million. As at 31 December 2022, 100% of the net proceeds from these green bonds have been fully utilised. Together with the green loan, the proceeds have been allocated to the following green projects: HKD 5,891 million (96.5%) Allocation of Green Buildings HKD 183 million (3.0%) Green Bonds and Energy Efficiency Green Loan Renewable Energy HKD 17 million (0.3%) Proceeds (As at 31st Sustainable Water and December 2022) Wastewater Management HKD 12 million (0.2%) We issued our Green Finance Report 2022 in March 2023 which provides information on the green projects funded by our green bonds and green loan and the estimated quantitative environmental impact, including energy and water saving, renewable energy generations and wastewater management practices, among others. SUSTAINABLE DEVELOPMENT REPORT 2022 256

Sustainable Development Report 2022 Page 256 Page 258

Sustainable Development Report 2022 Page 256 Page 258