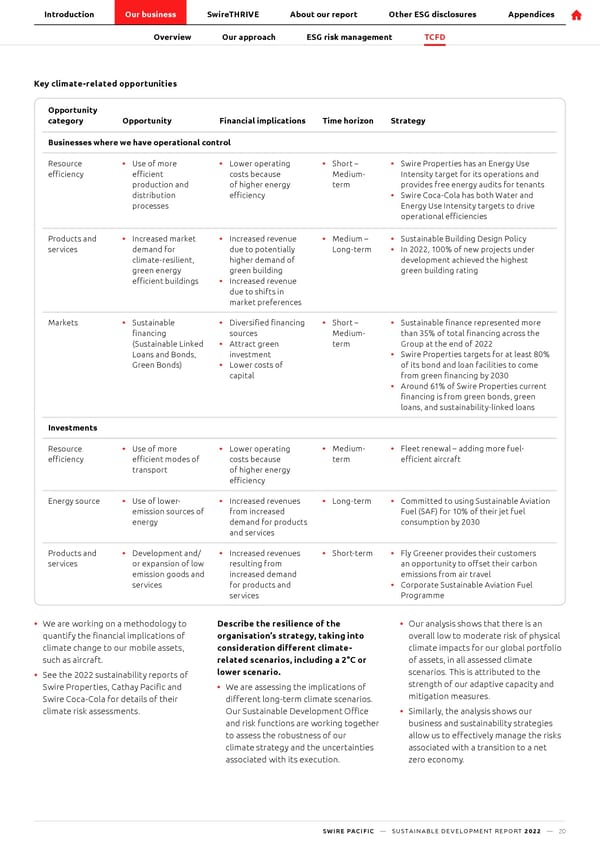

Introduction Our business SwireTHRIVE About our report Other ESG disclosures Appendices Overview Our approach ESG risk management TCTCFFDD Key climate-related opportunities Opportunity category Opportunity Financial implications Time horizon Strategy Businesses where we have operational control Resource • Use of more • Lower operating • Short – • Swire Properties has an Energy Use costs because Medium- Intensity target for its operations and e昀케ciency e昀케cient production and of higher energy term provides free energy audits for tenants • Swire Coca-Cola has both Water and distribution e昀케ciency processes Energy Use Intensity targets to drive operational e昀케ciencies Products and • Increased market • Increased revenue • Medium – • Sustainable Building Design Policy services demand for due to potentially Long-term • In 2022, 100% of new projects under climate-resilient, higher demand of development achieved the highest green energy green building green building rating • Increased revenue e昀케cient buildings due to shifts in market preferences Markets • Sustainable • Diversi昀椀ed 昀椀nancing • Short – • Sustainable 昀椀nance represented more sources Medium- than 35% of total 昀椀nancing across the 昀椀nancing • Attract green term Group at the end of 2022 (Sustainable Linked investment • Swire Properties targets for at least 80% Loans and Bonds, Green Bonds) • Lower costs of of its bond and loan facilities to come capital from green 昀椀nancing by 2030 • Around 61% of Swire Properties current 昀椀nancing is from green bonds, green loans, and sustainability-linked loans Investments Resource • Use of more • Lower operating • Medium- • Fleet renewal – adding more fuel- costs because term e昀케cient aircraft e昀케ciency e昀케cient modes of transport of higher energy e昀케ciency Energy source • Use of lower- • Increased revenues • Long-term • Committed to using Sustainable Aviation emission sources of from increased Fuel (SAF) for 10% of their jet fuel energy demand for products consumption by 2030 and services Products and • Development and/ • Increased revenues • Short-term • Fly Greener provides their customers services or expansion of low resulting from an opportunity to o昀昀set their carbon emission goods and increased demand emissions from air travel services for products and • Corporate Sustainable Aviation Fuel services Programme • We are working on a methodology to Describe the resilience of the • Our analysis shows that there is an quantify the 昀椀nancial implications of organisation’s strategy, taking into overall low to moderate risk of physical climate change to our mobile assets, consideration di昀昀erent climate- climate impacts for our global portfolio such as aircraft. related scenarios, including a 2°C or of assets, in all assessed climate • See the 2022 sustainability reports of lower scenario. scenarios. This is attributed to the strength of our adaptive capacity and Swire Properties, Cathay Paci昀椀c and • We are assessing the implications of Swire Coca-Cola for details of their mitigation measures. di昀昀erent long-term climate scenarios. climate risk assessments. Our Sustainable Development O昀케ce • Similarly, the analysis shows our and risk functions are working together business and sustainability strategies to assess the robustness of our allow us to e昀昀ectively manage the risks climate strategy and the uncertainties associated with a transition to a net associated with its execution. zero economy. SWIRE PACIFIC — SUSTAINABLE DEVELOPMENT REPORT 2022 — 20

SwirePacific SD Report Page 20 Page 22

SwirePacific SD Report Page 20 Page 22