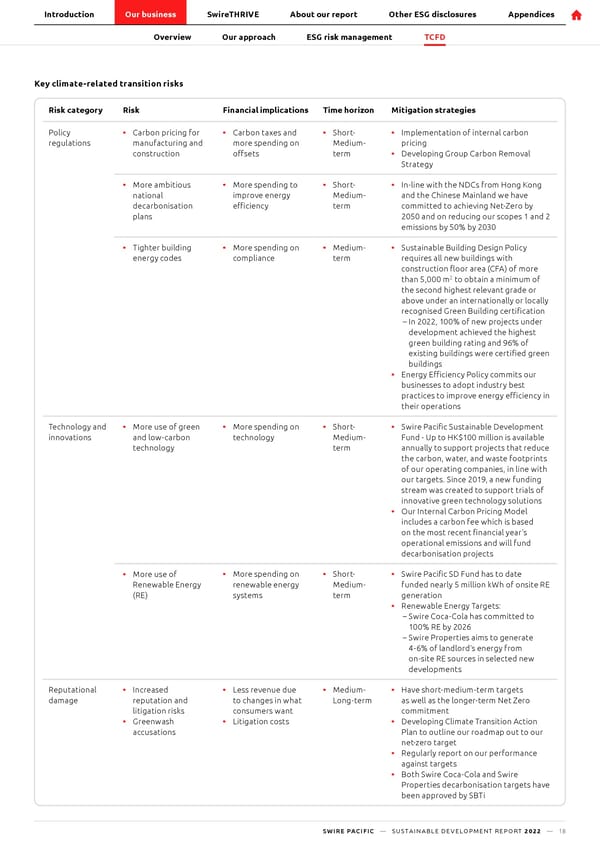

Introduction Our business SwireTHRIVE About our report Other ESG disclosures Appendices Overview Our approach ESG risk management TCTCFFDD Key climate-related transition risks Risk category Risk Financial implications Time horizon Mitigation strategies Policy • Carbon pricing for • Carbon taxes and • Short- • Implementation of internal carbon regulations manufacturing and more spending on Medium- pricing term • Developing Group Carbon Removal construction o昀昀sets Strategy • More ambitious • More spending to • Short- • In-line with the NDCs from Hong Kong national improve energy Medium- and the Chinese Mainland we have term committed to achieving Net-Zero by decarbonisation e昀케ciency plans 2050 and on reducing our scopes 1 and 2 emissions by 50% by 2030 • Tighter building • More spending on • Medium- • Sustainable Building Design Policy energy codes compliance term requires all new buildings with construction 昀氀oor area (CFA) of more than 5,000 m2 to obtain a minimum of the second highest relevant grade or above under an internationally or locally recognised Green Building certi昀椀cation – In 2022, 100% of new projects under development achieved the highest green building rating and 96% of existing buildings were certi昀椀ed green buildings • Energy E昀케ciency Policy commits our businesses to adopt industry best practices to improve energy e昀케ciency in their operations Technology and • More use of green • More spending on • Short- • Swire Paci昀椀c Sustainable Development innovations and low-carbon technology Medium- Fund - Up to HK$100 million is available technology term annually to support projects that reduce the carbon, water, and waste footprints of our operating companies, in line with our targets. Since 2019, a new funding stream was created to support trials of innovative green technology solutions • Our Internal Carbon Pricing Model includes a carbon fee which is based on the most recent 昀椀nancial year’s operational emissions and will fund decarbonisation projects • More use of • More spending on • Short- • Swire Paci昀椀c SD Fund has to date Renewable Energy renewable energy Medium- funded nearly 5 million kWh of onsite RE systems term generation (RE) • Renewable Energy Targets: – Swire Coca-Cola has committed to 100% RE by 2026 – Swire Properties aims to generate 4-6% of landlord’s energy from on-site RE sources in selected new developments Reputational • Increased • Less revenue due • Medium- • Have short-medium-term targets damage reputation and to changes in what Long-term as well as the longer-term Net Zero litigation risks consumers want commitment • Greenwash • Litigation costs • Developing Climate Transition Action accusations Plan to outline our roadmap out to our net-zero target • Regularly report on our performance against targets • Both Swire Coca-Cola and Swire Properties decarbonisation targets have been approved by SBTi SWIRE PACIFIC — SUSTAINABLE DEVELOPMENT REPORT 2022 — 18

SwirePacific SD Report Page 18 Page 20

SwirePacific SD Report Page 18 Page 20