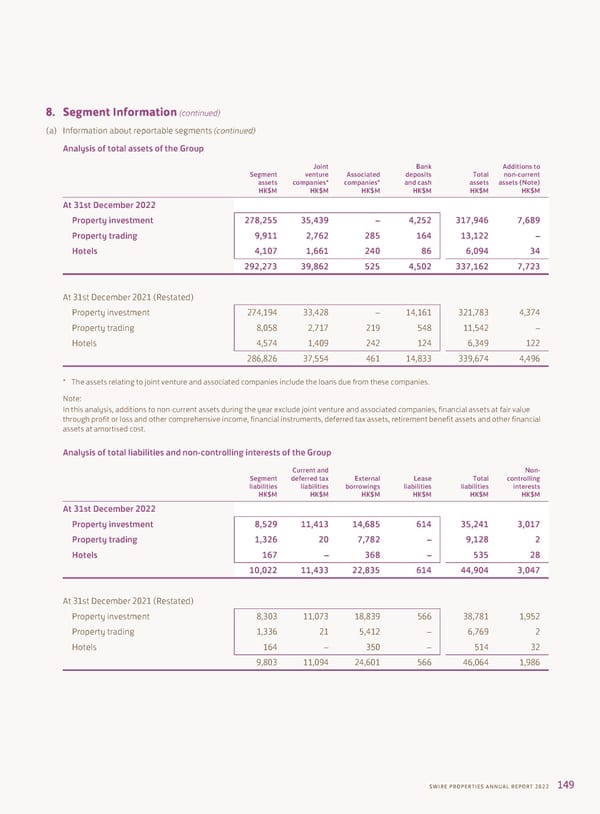

8. Segment Information (continued) (a) Information about reportable segments (continued) Analysis of total assets of the Group Joint Bank Additions to Segment venture Associated deposits Total non-current assets companies* companies* and cash assets assets (Note) HK$M HK$M HK$M HK$M HK$M HK$M At 31st December 2022 Property investment 278,255 35,439 – 4,252 317,946 7,689 Property trading 9,911 2,762 285 164 13,122 – Hotels 4,107 1,661 240 86 6,094 34 292,273 39,862 525 4,502 337,162 7,723 At 31st December 2021 (Restated) Property investment 274,194 33,428 – 14,161 321,783 4,374 Property trading 8,058 2,717 219 548 11,542 – Hotels 4,574 1,409 242 124 6,349 122 286,826 37,554 461 14,833 339,674 4,496 * The assets relating to joint venture and associated companies include the loans due from these companies. Note: In this analysis, additions to non-current assets during the year exclude joint venture and associated companies, financial assets at fair value through profit or loss and other comprehensive income, financial instruments, deferred tax assets, retirement benefit assets and other financial assets at amortised cost. Analysis of total liabilities and non-controlling interests of the Group Current and Non- Segment deferred tax External Lease Total controlling liabilities liabilities borrowings liabilities liabilities interests HK$M HK$M HK$M HK$M HK$M HK$M At 31st December 2022 Property investment 8,529 11,413 14,685 614 35,241 3,017 Property trading 1,326 20 7,782 – 9,128 2 Hotels 167 – 368 – 535 28 10,022 11,433 22,835 614 44,904 3,047 At 31st December 2021 (Restated) Property investment 8,303 11,073 18,839 566 38,781 1,952 Property trading 1,336 21 5,412 – 6,769 2 Hotels 164 – 350 – 514 32 9,803 11,094 24,601 566 46,064 1,986 SWIRE PROPERTIES ANNUAL REPORT 2022 149

2022 Annual Report Page 150 Page 152

2022 Annual Report Page 150 Page 152